Ever thought of “Coin Burn” and why it is so common in the crypto space? Or why are coins even burned?

In today’s article, I will take you through Coin burn and all you need to know.

Coin Burn is a common norm in the crypto space! It is the utter removal of cryptocurrencies from circulation.

This concept has, in fact, gained popularity, having been adopted by major cryptocurrencies, like, BNB, BCH, BAKE, and more.

If you want to know how Coins are burned, then, join me as I take you through this review!

Post Summary

Here is what I will cover;

- What is Coin Burn?

- Categories of Coin Burn

- Methods Of Coin Burning

- Why Are Coins Burned?

- Cryptocurrencies That Use Coin Burn

- Does Coin Burn Boost The Potential Of A Coin?

- Conclusion

I embedded a link to each of these items…feel free to use them and skip around to the section that tempts you the most.

All set? Now, let’s get started!

What is Coin Burn?

For some people, the idea of “Coin burn” would paint this awe picture where a heap of cryptocurrency is discarded into a pit of fire.

Far from this, Coin burn has nothing to do with setting a cryptocurrency on fire (that is totally a wrong conception).

Now, to explain Coin burn properly:

Coin burn is a mechanism used by the developers of cryptocurrencies to slow down the inflation rate of their coin.

You can best describe Coin burn as the permanent removal of a partial amount of cryptocurrency from circulation.

This is purposefully done to create an artificial scarcity, thereby increasing the price value of that coin, following the theory of demand and supply.

For instant, the recent Coin burn of the BAKE token has seen its price skyrocket to approximately $5.68 (April 29, 2021).

Coin burn happens when a crypto developer or miner intentionally transfer a fraction of a coin in circulation to an inaccessible wallet address.

It is “inaccessible“, in the sense that, the wallet in which the cryptocurrencies were sent has no Private Key and is, in fact, nonexistent.

You can imagine this to be a scenario where someone sends his BTC to the wrong wallet address.

All coins that have undergone the Coin burn process can never be redeemed (they are lost forever!).

I have only given you a short primer… Scroll through to find all the information about Coin burn.

Categories of Coin Burn

The two major categories of Coin burn are;

1. Coins originally created with the Coin Burn mechanism

These are cryptocurrencies that have “Coin burn” integrated into their protocols’ design on the blockchain.

Coins in this category are mostly referred to as deflationary tokens, and they carry out their “coin burn mechanism” automatically,

Here are some of the coins that belong to this category; FEG, BOMB, BOOM, FUN etc.

2. Coins that implement the Coin Burn mechanism artificially

For this group of coins, the “Coin burn” mechanism is not integrated into their protocol’s design.

It is, instead, artificially implemented by the team behind a cryptocurrency project or miners.

In this category, Coin burn could be carried out once or repeatedly in a periodic timeframe.

The coins that belong to this category include; BNB, CAKE, BCH, BAKE. etc.

We will check out the different methods of Coin burn in the next section. Read below!

Methods Of Coin Burning

These are the several ways used by crypto developers to burn their cryptocurrency.

Coins are burned following these 6 different methods/strategies;

- Through a smart contract known as the Burn Function

- Buy-back-and-burn

- Coin burn at every transaction level

- Coin burn after ICO

- Coin burned to maintain a price peg

- Proof-of-burn

1. Through a smart contract known as the Burn Function

Binance Academy gave a step-by-step guide on how this works…find it below;

- The team “behind the cryptocurrency” uses the burn function stating that they want to burn a certain amount of coin…let’s say 350 million coins.

- The Smart contract will verify if the team has these coins in their wallet

- If the team has these 350 million coins – the smart will go on and subtract them from the team’s wallet address.

- These coins will be burned (lost forever), and the total supply of that coin will then be updated

Note that the burn function would not have executed if the team never had up to 350 million coins in their wallet.

2. Buy-back–and-burn

Usually, when there are lots of cryptocurrencies (let’s say BNB) in circulation, the coin may lose its value due to inflation.

Now, to control this expected turn of event, the team behind this coin (BNB) would go to the market and buy back a large amount of their coin.

They will buy back these coins using a percentage of the profit that they have made from it (their coin, so far).

When they repurchase them, they will burn them entirely from circulation.

This typically reduces the supply of that coin and also makes its price a bit stable.

You can as well relate this to the Buy-back-and-burn strategies adopted by most publicly traded companies.

3. Coin burn at every transaction level

One of the cryptocurrencies that utilizes this method of coin burn is the FEG token.

Using the FEG token burn to explain this:

On each FEG transaction, a tax of 1% is distributed to the holders and another 1% is burned, hence incentivizing holders to hold FEG.

The XRP token also implements this model of Coin burn by burning 0.00001 XRP for every transaction performed.

4. Coin burn after ICO

This is typical of a crypto project burning their unsold tokens after an ICO.

It happens especially when the crypto project could not sell off all the tokens allotted for ICO.

Coin burn after ICO reinforces investors to hodl and believe in the long-term potential of the coin that they have just invested in.

One of the crypto projects to have used this method is HaggleX.

5. Coin burned to maintain a Price Peg

This method of coin burn mostly applies to stable coins, wrapped tokens, and synthetic assets.

Here, coins are burned so that they can retain the value of the assets that they are pegged to.

According to SwissBorg, Stablecoins like USDT, GUSC, USDC and HUSD conduct burns when the coins minted into their reserves are withdrawn. This helps to regulate their circulating supply and keep the balance stable.

Additionally, the DeFi project, Synthetix, uses this method of “Coin burn” to maintain the synths peg to the SNX debt pool.

6. Proof-of-Burn

Proof-of-burn is one of the consensus mechanisms that was propounded by Iain Stewart.

It is a mechanism used by miners to destroy cryptocurrency in a verifiable manner.

In Proof-of-burn, miners become able to mine when they send a coin to a verifiable inaccessible wallet address.

Also, the blocks that they are able to mine are in proportion to the coins that they have burned.

That is to say, the more coins a miner burns, the more more block they are able to mine.

An example of a project that uses this mechanism is Slim coin.

In addition, there is a feature in the Proof-of-Burn mechanism that allows new coins to be generated by burning a Proof-of-Work cryptocurrency, e.g. BTC.

Next, I want to talk about “why coins are burned”.

Scroll down!

Why Are Coins Burned?

I will be giving 5 useful resons for coin burn;

- For the growth and increase in value of a coin

- Reward coin hodlers

- Create a new asset

- For mining right

- Protection against spam

1. For the growth, stability, and increase in value of a coin

Coin burn can cause a parabolic movement in the price value of a coin.

An example is a rapid increase in the price of the XLM token shortly after a total of 50 billion XLM in circulation were burned,

Like the saying goes “The rarer a token, the more valuable it becomes”.

As more and more coins are burned, their total supply will keep dropping and eventually making them a bit rare than they were.

You can also view this from the limelight of crypto projects that use Coin burn as a deflationary mechanism to counter inflation.

As an example, the CAKE token is inflationary by way of creation, but it also adopts Coin burn as a mechanism that will bring stability to its ecosystem.

2. Reward coin hodlers

When the price of a coin increase as a result of Coin burn, their hodlers also enjoy an increase in the value of their investment.

Let’s say that you bought one BNB at the price of 40,000NGN.

However, a few weeks later, the price of BNB skyrocketed to 200,000NGN as a result of coin burn.

You would notice that you have made 160,000NGN off your BNB.

3. Create a new asset

Proof-of-Burn is one of the mechanisms used in generating new coins into existence.

For instance the creation of XCP coin requires the burning of BTC.

Also, miners that successfully mine a block using the Proof-of-Burn model will get mining rewards for their efforts.

4. For mining right

Based on the principle of Proof-of-Burn, miners burn coins to become eligible to mine blocks.

Because the power or weight of the burned coins to mining capacity depreciates with time, they need to burn coins more frequently to sustain their mining power.

5. Protection against spam

Coin burn limits the possibility of a DDoS attack on the blockchain by reducing the number of transactions that are sent on its network.

This it does by burning a small amount of coin in every single transaction.

The point raised here is one of paramount importance as it is relatable to the 2016 DDoS attack on Ethereum.

In the next section, I will talk about coins that have embraced the coin burn mechanism.

Just scroll down.

Cryptocurrencies That Use Coin Burn

A lot of cryptocurrencies have and are still carrying out Coin burn to boost their ecosystem.

I will briefly talk about 4 of these cryptocurrencies here.

i. BNB

BNB is the cryptocurrency that powers the entire Binance ecosystem. It is currently the 3rd most performing cryptocurrency.

At every quarter of the year, the team at Binance burns a fraction of the BNB coin.

They achieve this by repurchasing BNB from its investors with a 20% profit made in the last quarter and then send them to an unspendable address.

Initially, BNB coin had a total supply of 200 million coins. However, this total supply has kept reducing following its frequent burn.

(Binance has carried out its 15th BNB burn and up to 1,099,888 BNBs were burned)

As of the 30th of April, 2021, the total supply of BNB recorded on Coinmarketcap is 170,532,785, while its circulating supply is sitting at 169,432,897 coins.

Note that: BNB was initially an ERC-20 token, and its coin burn was conducted on the Ethereum network.

However, all BNB ERC-20 tokens were swapped for BNB BEP-2 when the Binance Chain network launched.

This means that the Coin Burn events now take place on the Binance Chain and not on the Ethereum network.

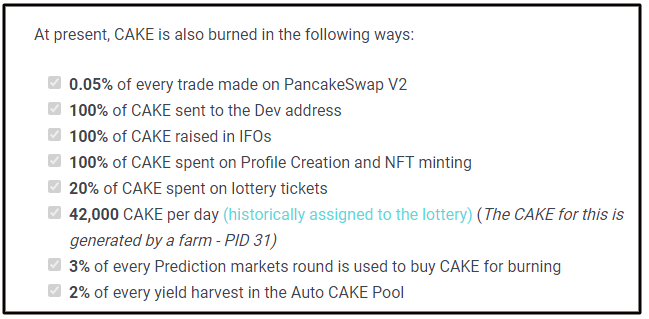

ii. CAKE

CAKE is the native token that powers the PancakeSwap ecosystem.

There’s currently no total supply of the CAKE token, and this basically makes it inflationary.

However, to keep the supply of CAKE on guard, the team came up with a Coin Burn mechanism.

The Coin burn mechanism was set to reduce CAKE’s supply per block at (-18), and its daily supply at (-560,400).

See how the CAKE’s token is burned below;

iii. CRO

Crypto.com announced that it will burn 70 billion CROs (their native token), earlier this year ( Feb 2021).

According to their blog post;

- 59.6 billion CRO tokens will be burned on the 22nd Feb. 2021

- 10.4 billion will be locked in a smart contract and will be burned monthly as it gets unlocked.

This has actually become the largest Coin burn that history has ever recorded.

The Coin burn was to make their blockchain network – Crypto.org chain, fully decentralized.

Also, it will increase the level of the circulating supply of CRO from 24% to over 80%.

However, the most interesting part of this CRO coin burn news is that its price rallied by over 70% within 24-hours, shortly after the announcement.

iv. Bitcoin Cash (BCH)

Bitcoin Cash has also seen its price value headed to the sky as a result of coin burn.

In 2018, a cryptocurrency mining pool Antpool announced that they were burning 12% of the Bitcoin Cash coins it received as block rewards.

This significantly drove up the price of Bitcoin Cash in a week, owing to the fact that Antpool validates nearly 10% of Bitcoin Cash’s transactions.

Also, reports have recorded Wormhole – a blockchain project that burns BCH to create an equivalent amount of its native token WHC.

There you have the list of coins that have adopted the coin burn mechanism.

Now, it is not arguable that Coin burn reduces the total supply of cryptocurrencies. However, does it really guarantee that a coin will do well in the future?

Scroll down and find my opinion.

Does Coin Burn Boost The Potential Of A Coin?

Some crypto holders believe that the price of a crypto asset will go up following its burn.

However, this is only a matter of probability and not a guarantee.

I say this because of these few points listed below;

1. Use Case

Most cryptocurrencies do not have unique and rare use cases.

As such, they might not experience any increase in value despite their burn.

2. Adoption

Another factor is that “Coin burn” may not be that impactful if a cryptocurrency does not have a massive community adopting it.

For instance, the FEG token is a deflationary token with a maximum circulating supply of 100 quadrillions.

1% of this token is burned in every single transaction.

As of May 2020, the price of this token is at <$0.00000001 with only 17,409 holders.

3. Hard Fork

Hard fork refers to a radical change to the protocols of a blockchain network. In simple terms, a hard fork splits a single cryptocurrency into two and results in the validation of blocks and transactions that were previously invalid, or vice-versa

https://corporatefinanceinstitute.com/resources/knowledge/other/hard-fork/

Coin burn creates a false sense of a coin’s scarcity especially when a coin has undergone (or can still undergo) a hard fork.

Take for example:

Bitcoin is seen as valuable because its total supply is capped at 21 million tokens.

However, Bitcoin has created new tokens (BCH, BTG, BTCP) through hard forks.

So assuming BTC undergoes coin burn… YES, its 21M supply will reduce.

But don’t forget its forks – BTG, BCH, etc. still have their quantities intact.

And let’s not rule out the possibility of another hard fork.

So coin burn doesn’t really do much removal for coins like this.

Alright, let’s head over to the concluding part of this article!

Ps: If you want to learn how to trade cryptocurrencies profitably, we developed a perfect course to help you master Cryptocurrency Trading.

Go to www.ctmastery.com to enrol.

Conclusion

Coin burn is a sought after measure used by crypto projects to bring deflation of their native currency.

Its goal is to increase the value and trust of investors in a coin but sometimes, that is never the result gotten.

This section marks the end of this review. Hope you enjoyed the post?

Now, I want to get your comments;

Do you see Coin Burn becoming a thing in the world of cryptocurrency?

Ever bought a coin out of Coin Burn FUD or FOMO? How did it turn out?

I am right there in the comment section waiting for your reply.

And before you go, endeavour to click on any of the share buttons.

Cheers!

Interesting articles;

0 Comments