In this post, I did a complete review of Luno.

Luno is a cryptocurrency exchange where users can buy, sell, send, and receive Bitcoin and Ethereum. It was formerly known as Bitx but later rebranded to Luno.

I have been using this exchange consistently from 2016 to this date.

I wrote my first review of this exchange in 2017.

In this 2022 review update, I not only gave a total rundown, but I also included a video on how to trade profitably on Luno.

This review is the most detailed and concise Luno Review online. So if you are ready to know all there is about Luno, read on.

Luno Review Brief

To smoothly walk you through this exchange, here is what I will be covering

- Company Overview

- Luno Features

- Luno Services

- Supported Currencies and Payment Methods

- Transaction Fees

- Deposit and Withdrawal Limits

- Supported Countries

- Customer Support

- Luno Vs Quidax

- Luno Vs Remitano

- Luno Vs Coinbase

- FAQs About Luno

- Conclusion – Is Luno Reliable?

Clicking on any of the links above will take you straight to that section.

1. Company Overview

Luno (formerly known as Bitx) is a cryptocurrency exchange/wallet provider.

It started as Bitx in 2013 in Singapore and expanded to several other countries.

On Jan 11, 2017, its changed brand name from BitX to Luno (meaning ‘Moon’).

This must have been a well-thought rebranding because this company grew exponentially in 2017.

Luno provides Bitcoin services similar to that of Coinbase. However, it was able to make all its services available in countries where Coinbase exchange services are not supported.

Luno is the most popular exchange in South Africa as it records its highest trading volume there followed by Nigeria.

Now that we know a brief history of the company, let’s look at its features

2. Luno Features

- Large Trading Volume

- Tight Spread

- Customer Support Via LiveChat

- Instant Buy and Sell

- Easy to Use Trade Room

- Price Alert

- Instant deposit

- Mobile App

- Multiple Currency

- Safe Secure system

- Referral

3. Luno Services/Products

Luno offers the following service and Products

- Instant buy/sell

- Exchange

- Wallet

- Luno Business

- Luno API

- Savings Wallets

1. Luno Instant Buy/Sell

Here users can purchase and sell Bitcoin and Ethereum instantly with fiat currencies like the NGN or ZAR. The transaction fee at the ‘instant buy/sell’ starts at 2% but could go higher.

Note: In the August 2019 update of the site, this section is no longer called instant buy/sell. However, you can access this feature from the wallet.

Also, limits apply when buying here. The limits are per transaction and depend on your country. For Nigeria, the minimum buy/sell is 50 naira while the maximum buy-sell is 3.6 million NGN.

Note that this is per transaction on the instant buy/sell not on the exchange.

For limits on other countries, click here.

2. Luno Exchange

The Luno exchange is a ‘Trade Room’ where you can trade cryptocurrency pairs.

It provides charts and indicators sufficient for both pro and new traders to conduct analysis before placing trades.

Depending on your country, you have various cryptocurrency pairs available for trading.

For example, in Nigeria, you have BTC/NGN, ETH/NGN, XRP/NGN, etc. available for trading.

Transaction fees can be as low as 0.03% or as high as 1% depending on your country.

I gave more details on the transaction fee section of this post. I also showed how to pay zero transaction fees when trading.

3. Luno Wallets

Luno provide wallets for the following currencies

- All supported cryptocurrencies – buy, sell, send, receive, and store

- Fiat wallet (NGN, ZAR, EUR, IDR, MYR, ZMW) – Deposit, withdraw, exchange for cryptos

Note: You can only access the fiat wallet for your country.

4. Luno Business:

Luno business account is designed for companies that have a large fund and want to do more than just trade Bitcoins.

This account type is meant to attract trading firms, financial service firms, Miners, Cryptocurrency startups, etc.

5. Luno API

Luno API gives developers access to perform certain actions on their Luno account through another platform; this can be automated trading, generating BTC addresses, sending and receiving, etc.

6. Savings Wallet

Luno allows its users to save their BTC, ETH, and USDC on its platform and earn up to 4% interest per annum.

How this works is that you will create a Savings wallet and transfer your coins in it to earn.

These coins are then lent to Luno’s trusted lending partner who enters into individual loans with third parties.

The interest will be paid into your Bitcoin Savings wallet on the first day of each month.

Of the three Savings wallets, you can choose to create one, two, or all three; it’s your choice!

The interest on each is as follows:

- BTC Savings wallet – 2% interest

- ETH Savings wallet – 2% interest

- USDC Savings wallet – 7.6% interest

You can transfer your Bitcoin out at any time and at no charge.

The transfer to your wallet, though instant, can take from 1 – 7 business days.

Find more information here.

NOTE:

- You will start earning interest the next day at a variable interest rate.

- Your crypto will be lent to a third party and it is not insured or guaranteed.

These are the products and services available for now.

Let us look at its payment methods and supported currencies.

4. Supported Currencies and Payment Methods

Supported Cryptocurrencies

- Bitcoin (BTC)

- Ethereum (ETH)

- Bitcoin Cash (BCH)

- Ripple (XRP)

- Litecoin (LTC)

- USD Coin

The number of coins supported is not impressive and users have constantly queried why more cryptocurrencies are yet to be included.

I asked this question in the Luno Meet held in Port Harcourt Nigeria.

The answer was that the Team only wants to support cryptocurrencies with the strongest integrity that is why they take time to include a new coin.

However, the Luno team is planning to include more coins.

Supported Fiat Currencies

- Euro (EUR)

- Indonesia Rupiah (IDR)

- Malaysian Ringgit (MYR)

- Nigeria Naira (NGN)

- South African Rand (ZAR)

- Zambian Kwacha (ZMW)

Luno Accepted Payment Methods

It depends on the country you are operating from.

Have a look:

| Country | Currency | Payment Methods |

| Europe | EUR | Debit / Credit card, SEPA |

| Indonesia | IDR | Bank Transfer |

| Malaysia | MYR | Interbank Giro / IBFT |

| Nigeria | NGN | Bank Transfer, Debit card |

| South Africa | ZAR | Cash deposit, EFT |

| Zambia | ZMW | Bank Transfer |

Note: As of press time (1/17/2022), Nigerians can only make fiat transactions via a third party. Find full details here.

5. Transaction Fees

Transaction fees on Luno can be broken down into

- Send and receive fees

- Deposit and withdraw fees

- Trading fees

These fees vary from country to country and also depends on the payment method. Full details can be found here on the Luno site. However, here is the summary below.

Send and Receive Fees

| Currency | Method | Send Fee | Receive Fee |

| BTC | To Bitcoin address | Dynamic | Free |

| BTC | To email address | Free | Free |

| BCH | To Bitcoin Cash address | Dynamic | Free |

| ETH | To Ether address | Dynamic | Free |

| XRP | To Ripple address | 0.03% | Free |

| LTC | To Litecoin address | Dynamic | Free |

| USDC | To USDC address | Dynamic | Free |

Note: Send fees are not determined by Luno but by the blockchain network. The blockchain network fee varies from time to time hence ‘dynamic’ in the table above.

Deposit and Withdraw Fees

Just like the blockchain fees above, Luno does not determine the deposit and transaction fees.

They employ the services of payment processors who process payments from and to the Fiat wallets.

The fees depend on the payment processor and are calculated before you proceed with payment.

| Currency | Method | Fee |

| NGN | Payment Voucher | 20NGN per 1,000NGN Capped at 5,000NGN |

| EUR | SEPA, iDEAL, SOFORT, Card | Free |

| MYR | Interbank GIRO / IBFT | Free |

| ZAR | EFT | Free |

| ZAR | Cash Deposit Penalty | ZAR 20.00 + 5.00% |

| IDR | Bank Transfer | Free |

| IDR | SMS, ATM, Inter banking | IDR 4,000.00 |

| ZMW | Bank Transfer | Free |

Trading Fees

This is how Luno generates its revenue. The fee varies depending on the country.

The Instant buy/sell charges 2% or higher.

At the exchange, the Taker pays a transaction fee depending on the country he is trading from and his trade volume for the past 30 days.

The Maker pays no fee.

Note: The ‘Maker’ is the person that sets the buy/sell price at the exchange while the ‘Taker’ is the one that buys/sells at the price set by the ‘Maker’.

Get more details on the fees here.

That said, there are limits to the amount you can withdraw or deposit to your fiat wallet based on your verification level.

Let’s look at it below.

6. Deposit and Withdrawal Limits

The user’s country and verification level determine the deposits and withdrawal limits.

The table below shows that for Nigeria, South Africa, and Europe.

| LEVELS | REQUIREMENTS | DEPOSIT | WITHDRAWAL |

| Level 0 | Email verification | Not allowed | Not allowed |

| Level 1 | Phone verification | All-time Deposit NGN 200,000 ZAR 15,000 EUR 1,000 | All-time Withdrawal NGN 200,000 ZAR 15,000 EUR 1,000 |

| Level 2 | ID verification | Max. Deposit/month NGN 500,000 ZAR 50,000 EUR 5,000 | Max. Withdrawal per month NGN 500,000 ZAR 50,000 EUR 5,000 |

| Level 3 | Proof of Residency | Max. Deposit/month NGN 10,000,000 ZAR (limit may apply) EUR 100,000 | Max. Withdrawal per month NGN 10,000,000 ZAR (limit may apply) EUR 100,000 |

Note: To go above the deposit and withdrawal limits in level 3, you have to apply for a business account as described earlier above.

So far, you will notice that I have only mentioned certain fiat currencies. This is because Luno does not support all countries.

Let’s look at the supported countries proper.

7. Supported Countries

Luno currently supports over 40 countries. They include;

- Nigeria

- South Africa

- Indonesia

- Malaysia

- Zambia

- Belgium

- Bulgaria

- Croatia

- France

- Germany

- Sweden

- Switzerland

- United Kingdom

- Slovenia

- Austria

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- Greece

- Guernsey

- Hungary

- Portugal

- Romania

- San Marino

- Slovakia

- Spain

- Iceland

- Ireland

- Isle of Man

- Italy

- Jersey

- Latvia

- Liechtenstein

- Lithuania

- Luxembourg

- Malta

- Monaco

- Netherlands

- Norway

- Poland

The country with the highest daily ‘Trade Volume’ is South Africa followed by Nigeria.

8. Customer Support and Public Opinions

In the intro of this post, I said that I have been using Luno since 2016, so there is a lot I can say about customer support.

Luno Customer Support back in 2016/2017 was really poor. However, there has been a significant improvement. Although I believe more can be done.

The exchange has a very extensive HELP CENTER. You will find answers to most questions here.

In case you don’t find answers to your query in the HELP CENTER, you will have to contact customer support via LIVE CHAT or submit a support ticket.

The LIVE CHAT is not available 24/7 and replies to support tickets are usually within 24 hours.

You might need to contact support more than once to have your queries resolved as their first response are sometimes generic.

Luno has a very low rating on Trust Pilot mostly from people complaining of blocked accounts or pending transactions.

There are several reasons why this could occur – it could be verification limit restriction, deposit from a bank account that does not bear the same name as the owner of the Luno account, etc.

That said, customer support could do better at attending to this issue.

It is worthy to mention however that bitcoin exchanges like Coinbase and Binance also have poor ratings on Trust Pilot.

We are also coming to the end of this review.

But before we get to the conclusion, let us compare Luno with its major rivalries and answer some of the Frequently asked questions.

Remember, I am still going to show you how to trade profitably on Luno. Read on

9. Luno vs. Quidax

Quidax was launched in 2018, 5 years after Luno.

So far, it has proven to be Luno’s major rivalry in Nigeria.

It operates a similar model to Luno but supports more cryptocurrencies.

Also, it processes withdrawals faster than Luno.

However, Luno beats Quidax in terms of liquidity.

Read our review of Quidax here

10. Luno vs. Remitano

Remitano, unlike Luno, is a P2P exchange where buyers and sellers can trade directly.

Remitano modulates the trades using escrow.

Luno for a long time now has been the choice trading platform in Nigeria while Remitano is the choice P2P platform.

There is really not much comparison angle between these two exchanges because they operate different business models.

Read my full review of Remitano here

11. Luno vs. Coinbase

Coinbase is one of the most used OTC cryptocurrency exchanges worldwide.

It supports the storage, buy/sell, and swap of more than 50 cryptocurrencies.

However, Coinbase does not have an integrated Trade Room like Luno (except in its Pro version).

It supports trading for 102 countries but unfortunately, Nigeria is not one of them.

This is where Luno has an edge.

Learn more about Coinbase here.

Also read:

- Luno Vs Coinbase – Which is Better for You? | The Complete H2H Comparison

- Coinbase Review(2020)| How Safe Is it?

12. Frequently Asked Questions About Luno

In this 2020 update of the Luno review, I decided to include some of the questions frequently asked from the comment section. So make use of this or you leave a question on what you are not clear about.

– Luno complies with the regulatory bodies of the countries it supports to ensure that the user’s fund in the fiat wallet remains safe.

– Its account is audited regularly.

– The CEO or CTO of the company cannot single-handedly withdraw the cryptocurrencies in the wallets or fiats in the bank account.

– Users can enable 2FA to increase the security of their Luno account.

Yes, here are the reasons;

The BVN (Bank Verification Number) is a number that unified all the bank account of a user in Nigeria. It was introduced by Nigerian Banks to protect customers from identity theft and fraud.

The Nigerian government made it mandatory for anyone who wants to have a bank account. The BVN can be said to be similar to the Social Security Number in the USA.

Nigerians need to provide their BVN to protect them against identity theft, improve service delivery and speed, and help restore their accounts if they lose their login.

Luno or anyone cannot gain access to your bank account information through your BVN. Secondly, it stores personal information including the BVN in a secure, encrypted form only accessible to authorized personnel.

1. Visit Luno and create an account

2. Verify your account to at least level 1 (phone verification)

3. Deposit fiat (e.g. Naira) to your Luno fiat wallet

4. Buy Bitcoin or Ethereum with the deposited money either at the instant buy/sell or at the exchange.

I gave a demo of this in the video below.

Withdrawals on Luno are now automated and fast 24/7.

They are processed in less than 5 minutes but on rare occasions, it could take up to an hour.

This is a laudable improvement considering that before then, it was processed 3 times a day on working days only.

Verve cards are not international cards, they are restricted for use in Nigeria alone. Luno supports over 44 countries and thus only accepts international cards like Master cards, Visa cards, etc.

Yes, Luno accepts international cards.

However, the name on the card must be the same on the Luno account else the transaction will not go through.

This is a necessary measure to prevent a stolen card from being used on Luno.

For security reasons, Luno does not share its office address with the public.

If you need to contact Luno, send an email to support@luno.com.

First, you need to create an account.

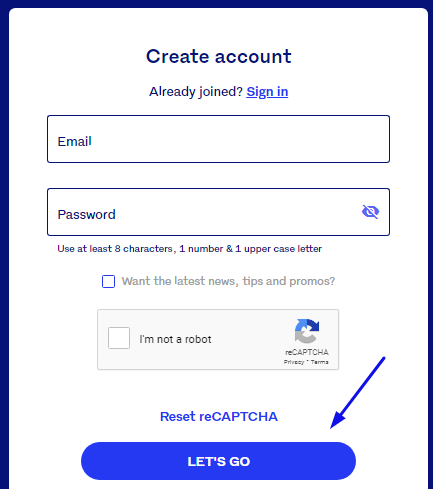

i. Go to luno.com and hit the ‘Sign up’ button at the top right.

ii. Enter your email and create a password and click on ‘Let’s go’

iii. Check your inbox and click on the link sent to you. Then click on ‘I’ve confirmed my email’

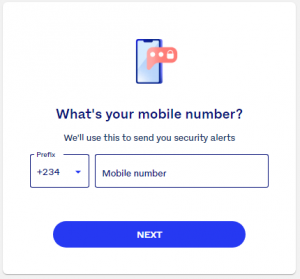

iv. Next, you enter your phone number and input the code sent to you to verify it

v. Voila! You’re in. Go ahead and explore the services

You can go ahead and watch this explainer video to learn how to buy/sell, send/receive, or trade cryptocurrencies on Luno 👇

Note that this is not financial advice it is what I do.

If you need financial advice, please seek the help of a professional.

Enjoy the Video.

13. Conclusion: Is Luno Reliable?

Judging from my experience so far, Luno has come to stay especially in countries overlooked by exchanges like Coinbase. No wonder its biggest market is in Africa.

It is also strengthening its bond with its users and keeping them abreast of the crypto world by holding several meetups in Nigeria. Luno holds yearly Meet up in Lagos, Abuja, Port Harcourt, and Enugu.

Though it has its pros and cons (see the rating below), it is continuously improving.

So, is Luno reliable? Absolutely.

That brings us to the end of the review of Luno,

And now it’s your turn. Tell me

Have you used Luno and what are your experiences?

In what area do you think Luno can get better?

Or maybe you have a question about something I wrote in this Luno Review 2020 Update?

Whichever it is, let me know in the comment section below.

If you enjoyed this post and want to encourage us to keep dishing out awesome content like this, then give us a share using the share buttons below.

I withdraw my funds from luno to afrivoucher and I wait for more than 2 hours but my money as not been send to my account

Hello Ademola, guess this would have been sorted by now.

If not, kindly reach out to its Customer Support Team for assistance.

Thanks

dm us on twitter for all your luno support @frank_mgr1

Is it necessary to deposit before withdraw from the wallet if you someone send money in your wallet from a different app using my luno wallet address can I still get access to my withdrawal

You can still withdraw if someone transfers to your wallet. You must not deposit before you can withdraw.

But note that you can only make withdrawals in crypto from Luno at the moment; no Naira withdrawals.

Hi

I’m Sylvester by name i red.through write ups abt Luna app

Now I want to ask as a newbie;

*What/are the steps, in creating a Luna accnt?

*After creating the account what follows?

What happened to luno trading I’m no longer make deposit to this app what is the next step Mr Jude.

P2P is the solution. They were affected by the CBN crypto ban

Does rise/fall of naira affect buying/selling on luno?

no

How do i upgrade to business account

contact the support

Can I withdraw more than #200,000 in a month on a level 1 verification from luno? Or its just a one time withdraw of 200k

one time. You have to upgrade

I requested a withdrawal of 10k from my luno account on the 6th of September, 2020 and until now my withdrawal is still pending..what should I do?

contact support

Why is Luno charging very high fee recently when sending crypto. I was charged over N3,000 for sending 50USD crypto. So disheartening!

It is not charged by luno but rather the bitcoin network fee (miner’s fee). Read this post to find out how you can minimize it https://www.nigeriabitcoincommunity.com/bitcoin-fees/

Please how much is d minimum I can withdrawal to my bank account?

300 naira I believe. Know however that you would have to pay 200 naira in withdrawal fee

Well explained for beginners. Thanks

Thank you. It’s my pleasure

Good day, while I wait for 2nd/3rd level Verification, can I receive any of the five coin worth more than 200,000 Naira

Yes. The verification restrictions are basically for deposit and withdrawal of fiat. It does not apply to Cryptos

Though, you have talked and explained good on Luno, but my still concern is BVN issue which banks in Nigeria against given third party. Am still not convinced either. May be Luno, itself can clarify this on its page for better and more trust.

luno actually have this clarified on their page.

Most financial institution in Nigeria will require your BVN from lending platforms like carbon to crypto platforms link luno and quidax.

This is a way that they will ensure that fraud is not commented on their platform.

That’s so right. Why request for BVN?

Every financial institution operating in Nigeria is mandated to conduct KYC on its customers.

The fastest way to do this and to confirm that the account you are registering belongs to you is through your BVN.

Note that no one can access the fund in your bank account through your BVN number. just as no one can access your bank account using your ID card.

See BVN as your electronic ID card.

Luno can only verify that you are who you say you are through your BVN.

This, however, does not mean you should give your BVN to anyone just the way you cannot give you ID to anyone.

You should only give it to registered and regulated financial institution.

What is your email address and phone number to contact you directly?

jude@nigeriabitcoincommunity.com

Good day mr Jude…I just credited my naira wallet on Luno and I want to know how to start tradind