In this article, I explained what leveraged tokens are and where you can buy them.

These tokens grant you enhanced gains on the crypto assets you’re interested in.

And if you do it right, you might not suffer any losses.

Mouthwatering, huh? But how is that possible?

Keep reading and you’ll find out!

Post Summary

- What Are Leveraged Tokens?

- How Leveraged Tokens Work

- Where Can I Buy Leveraged Tokens?

- Benefits And Risks Of Investing In Leveraged Tokens

- FAQs

- Final Thoughts

Click on any item above to read its details immediately.

1. What Are Leveraged Tokens?

Leveraged tokens are tokens that provide an extended value for their underlying asset.

They allow traders to gain a leveraged position on crypto assets.

In other words, they are traded as a different value of the original asset to boost profit.

For example, ETHBULL is a leveraged token that provides 3x the return on its underlying asset – ETH.

Additionally, leveraged tokens are ERC-20 tokens.

Also, their names and how they are managed differ from platform to platform.

For instance, the ETHBULL mentioned earlier is a 3x long Ethereum token on FTX.

The same token exists on Binance as ETHUP, which offers up to 4x leverage.

It’s a lot like margin trading but traders’ funds don’t face liquation when they buy these tokens.

And that’s because they reduce the risk of liquidation through ‘rebalancing.’

What Is Rebalancing?

This refers to the programming of leveraged tokens to automatically increase or decrease their positions.

When the token makes money, the profits will be reinvested.

But if it loses money, it will sell some of its position.

The goal here is to maintain the target leverage and avoid liquidation.

For example, if the price of ETH changes, the ETHBULL token will buy or sell ETH to maintain its 3x position.

Just like where a trading bot responds to preset conditions.

Also, rebalancing occurs at different times on different exchanges.

Some happen daily, others happen when there’s a dramatic change in the asset’s price.

Let’s see how leverage tokens work in the next section.

Keep reading!

2. How Leveraged Tokens Work

Although they are traded like other coins, these tokens operate differently.

Put simply, when there is a price change in an underlying asset, the price of the leveraged token adjusts based on its leverage.

Say you are holding a 3X Long Bitcoin Token and its price is $100.

Thus, the leverage is 3X.

In the case of a price increase by 3%, you’ll make a profit of $9 (3×3%) and if the price of the coin decreases by 3%, you’ll also lose $9 (3×3%).

That is to say, for every 1% Bitcoin goes up in a day, 3X Long Bitcoin Token goes up by 3%;

And for every 1% Bitcoin goes down, 3X Long Bitcoin token goes down 3%.

Interesting!

As for how to get these tokens, you can;

- buy or sell them on Spot markets;

- convert your cryptocurrency to them; or

- create/redeem leveraged tokens.

Next, let’s look at the exchanges that trade these tokens.

Tag along!

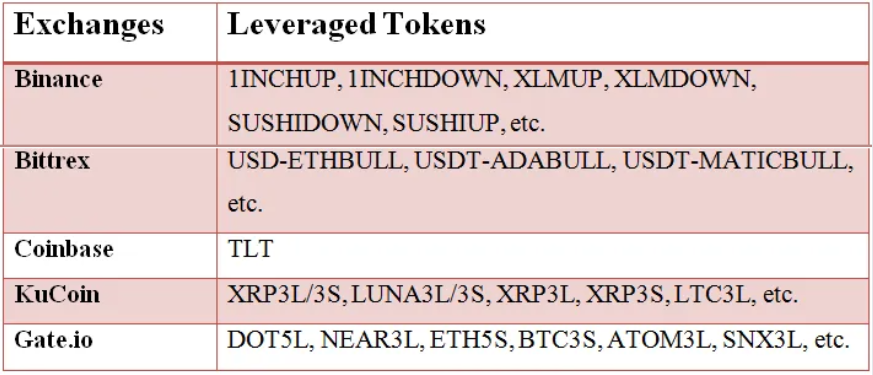

3. Where Can I Buy Leveraged Tokens?

Not many cryptocurrency exchanges sell these tokens.

Here’s a list of exchanges I found and the leveraged tokens available on them:

Remember that the management of leverage tokens varies on these platforms.

Moving on, I discussed the benefits and risks of trading these tokens.

Read on!

4. Benefits And Risks Of Investing In Leveraged Tokens

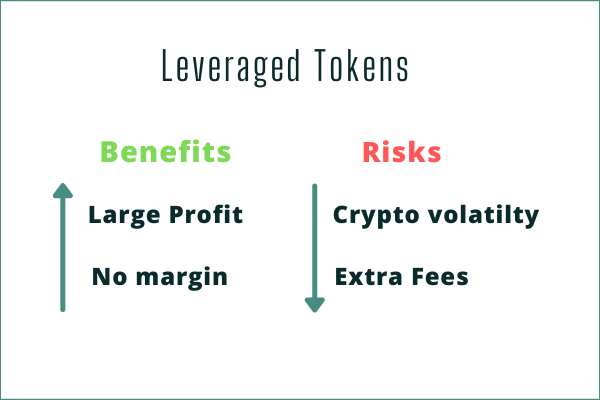

Benefits

a. Risk management

Leveraged tokens help to curb risks in trading.

They automatically reinvest the profit into the underlying asset.

Also, they sell some of their positions when the price drops.

Thus, preventing potential liquidation risk.

b. No Margin

Traders don’t have to worry about a margin call or liquidation or collateral with leverage tokens.

They pay just the price for the coin and still make the extra profit.

c. Instant withdrawals

Because leveraged tokens are ERC-20 tokens, you can withdraw them at any time.

Plus, you can send them to any ETH wallet or transfer them to another platform that supports them.

Cool!

Risks

a. Volatility Decay

Leveraged tokens are very susceptible to volatility decay.

What I mean is, a small loss on a normal crypto purchase makes for a big loss on a leveraged token.

Let’s do a comparison;

If I bought $100 worth of Bitcoin, and the price increases by 10% after a day, my investment becomes $110.

But if the price decreases by 10% the next day, meaning an $11 drop; my investment becomes $99.

On the other hand, if I invested the $100 in a 3X Long Bitcoin;

The 10% increase on day one will be a 30% increase, taking my investment up to $130.

Also, it would result in a 30% drop on day two, costing me $39 and leaving me with $91.

Oops!

b. Extra Fees

Leverage tokens attract extra fees known as management fees.

For example, Binance Leveraged Tokens have a daily management fee of 0.01%.

Then on FTX, it is 0.03%.

Therefore, these fees will ramp up to 3.65%, and 10% in a year respectively.

Pretty huge, huh?

Let’s answer some frequently asked questions and then we can wrap up this post.

5. FAQs

Leveraged tokens grant you leveraged positions in your crypto investments.

Therefore, they make a good investment choice.

However, endeavour to fully understand how they work and master the risks before buying these tokens.

Additionally, learn how rebalancing works on the platform you intend to use.

In leveraged trading, coins are held as collateral and used to open positions worth up to 3x (or more) of the collateral amount.

As a result, traders can increase profit potential by determining the direction of the market.

On the other hand, leveraged tokens offer similar benefits but in a simplified asset.

And the trader is not taking on an individual loan like with leveraged trading.

Instead, he is buying a token with a balanced pool of leverage.

Thus, enabling traders to perform leveraged trading without needing to set and monitor positions of their own.

Cool!

Hey!!!

You can also join our Telegram community at https://t.me/ctmastery

6. Final Thoughts

Considering the risks involved in leveraged tokens, they should not be traded as long-term investment.

Cryptocurrency is volatile, and as such, there is a high likelihood of losing money.

Only invest in leveraged tokens if you’re confident about the movement of the underlying asset.

If you guess right, you can dramatically boost your profits.

Otherwise, you can lose a significant part of your investment very fast.

Bottom line, if you’re interested in leveraged tokens, take time to study them and only put in money you can afford to lose.

So tell me, will you invest in leveraged tokens?

Perhaps, you already did, have you made good returns?

Type your responses in the comments section, and let’s engage.

Also, share this post with your friends. Thank you!

0 Comments