In today’s post, I disclosed the major risk management strategies that will help you mitigate loss as a crypto trader.

Now let me guess;

You are new to the world of crypto, but you are still not sure of what it means to trade without losing more than you can afford?

Well, by the time you read through this review, you must have discovered the strategies that will make you smile each time you trade.

Ready to learn? Let’s jump right in!

Post Summary

The discussion of this post will take the following order;

- What is Risk Management in Crypto Trading?

- Fundamental Risk Management Strategies That You Must Know

- Managing FUD & FOMO

- 5 Tips on Risk Management Strategies

- Conclusion

Tag along and enjoy the post!

What is Risk Management in Crypto Trading?

Risk management is the tactics used by a crypto trader to enable him to manage his crypto portfolio, and wage against excess potential loss.

Simply put – It is the amount of potential loss that you are willing to risk, perhaps the market goes against your expectation.

Risk management helps you to analyse and plan ahead of every trade you are about to place.

Not only that, it prioritizes protecting your capital over a large amount of profit you can make in a trade.

This is because you may end up losing all your capital in one trade which leaves the gains you envisioned to make totally unobtainable.

Risk taking is something inescapable for every crypto trader.

And for this reason, it becomes very pivotal that every trader must acquire certain risk management strategies to curb them.

Fundamental Risk Management Strategies That You Must Know

There are three risk management strategies that you must know as a crypto trader, and that is what I intend to discuss here below.

You can take a look at them,

1. Position Size

Your position size entails the amount of capital that you are prepared to risk in a single trade.

It is the total amount of money that you have allotted to buy or sell your cryptocurrency.

Position size encases or covers three different trading prices;

- Entry Price: The amount of money you have placed in a trade or the amount you entered the trade with.

- Target Price: The amount of profit that you have set to make

- Stop Loss Price: The price that you are willing to exit the market or the amount of risk that you are willing to take.

Read more about Position Size here.

In positioning your trade size, it is advised that;

- You never use all your capital in one trade

- Always trade with a low percentage of your capital

- Never go all in – Split your capital into different entry prices for different trades and isolate them

- You must see trading as the unity of many single trades which all together let your capital slowly grow.

- Position your trade based on an analysis of the market trend

To buttress the points above, let’s use a real-life example.

Let’s say you have 3 BTC in your crypto portfolio (or wallet), and you want to make a day trade with BTC against USD within a bearish trend.

Probably, you want to sell and buy back your Bitcoin at a lower price.

Now, what you can do is to, take 3% of your 3 BTC which will equal 0.09 BTC as your total capital for the whole trade you will perform at that period.

Then, split the 0.09 BTC into different trades until you have completely placed all your 0.09 BTC.

For instance; you can set a sell order with 20% of your 0.09 BTC, and when you see that the market behaves in your favour, you sell another 10% or 20%, and so on.

By so doing you will be able to make a profit on all trends of the market and also save the loss of your 0.09 BTC in one trade.

It is very important that you note that; position size is not determined by personal presumptions but by analysis and some calculations.

Below are some of the strategies that will help you calculate your position size.

- Kelly Criterion Strategy

- Using a Position Size calculator

i. Kelly Criterion Strategy

This is one of the popularized formulas used by the betting community to help them;

- Calculate what percentage of their capital to risk in an investment

- Diversify their investment portfolio to mitigate risk

This formula was discovered by a man known as John Kelly when he worked for AT&T Bell Laboratory.

Today, Kelly’s law has become one of the famous strategies used by investors to calculate their position size.

The equation for Kelly’s Percentage formula states that;

Where;

K% = The Kelly percentage

W = Winning Probability

R = Win/loss ratio

To get the mathematical analysis of this formula, you should click on the link here.

ii. Using a Position Size calculator

Here, I dropped a link to download the Afibie Position Size Calculator from the Play Store.

I will also give you the 4 steps to keep in mind when using the calculator.

- Input the sum total of your trading capital

- Determine the percentage of risk you are willing to take and insert it into the calculator

- Input your stop-loss percentage

- The calculator will show you the amount of position size that you should use to achieve your stop-loss target.

For this calculator to function, you must create your own copy by following the instructions that you find within.

2. Set Your Stop Loss & Take Profit Order

These are the two powerful risk management strategies that will help you to prevent loss and Maximize profit.

And it is very important that you use them always.

Stop Loss: A stop-loss puts a check on your risk and prevents you from losing too much in one single trade.

It exits your trade at a predetermined set price when the market is going against your expectations.

Take profit: This order automatically locks your profit and closes your trade once your profit target is reached.

Setting these two orders in place in every single trade gives you a win-win trade no matter the market condition.

3. Risk/Reward Ratio

This strategy is often used by traders to determine the amount of profit they stand to gain for every risk they take.

For example; A risk-reward ratio of 1: 3 implies that for every asset you trade, you are willing to make 3% profit and 1% loss.

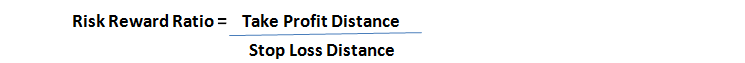

The Risk/ Reward Ratio is calculated thus,

Let us assume that your;

- Entry price = $22.889

- Take Profit = $25.344

- Stop Loss = $22.137

To calculate this, your ratio will be:

R = (25.344 – 22.889) / (22.889 – 22.137) = 3.26 which will give you a 1: 3.

In determining your risk/reward ratio, your reward should always be higher or equivalent to your risk.

Below, I am going to talk about two psychological trading problems affecting trading profitability and give you tips on how to manage them too.

Managing FUD & FOMO

FUD and FOMO are both human psychology of fear that can hinder one’s trading profitability.

FUD means Fear, Uncertainty and Doubt.

This often happens when you become agitated about your position in the market based on public opinion or certain speculation.

FUD causes “panic buy or sell of a coin” without fundamental and technical analysis.

FOMO on the other hand, stands for Fear of Missing Out.

It is the psychological fear that makes you want to buy a coin because everyone is doing so.

This happens when a trader buys or sell a coin based on the advice of Hype traders who got lucky and made a profit of that coin they want to buy.

Traders who enter the market based on FUD & FOMO are invariably in the position of losing money.

As a crypto trader overcoming these two situations is very indispensable.

For this reason, I will be putting down below a few helpful tips on how to deal with FUD & FOMO

- Adjust your thought process; do not be motivated to trade by a mere wite up on social media

- Eliminate Greed and sentiments; focus on analysing the trends of the market before entering your trade

- Take a look at the #FOMOintrading and #FUD ( hashtags on Twitter) to verify the current situation of the social trend

- Be decisive -ensure that you are ready to trade before doing so

- Conduct technical analysis and do your own research

Having discussed all the strategies that I have for today, let’s now jump into the next subheading.

5 Tips on Risk Management Strategies

Building a lifetime wealth in cryptocurrency largely depends on certain skills and knowledgeable consideration.

Here are some other factors that will make ore mare your trading profitability

- Get Rich Quick Scheme

Majority of crypto traders jump into trading upon seeing that a friend or so made a tidy sum of money in cryptocurrency.

Hence, the quest to accumulate gifted wealth in cryptocurrency too.

This is not so here. It takes patience, dedication and the right kind of attitude to make a fortune in crypto.

- Trading with a Borrowed Money

If you are planning on trading cryptos with a borrowed money, then, I will advise you to refrain from doing so.

The reason for this is simple – Have you ever imagined what will happen if the crypto exchange you are using gets hacked?

Worst still, you may not have made enough of the profit to pay back your loan before the duration expires.

- Trade with Money that you can afford to lose

Trading with money that you can afford to lose is the golden rule in crypto trading.

Making a profit and taking a risk is a 50/ 50 game in any investment.

As such, there is also a possibility that you can lose all your money in a single trade.

This is not to say that profit not guaranteed in crypto trading, but to emphasize the importance of risk management skills.

- Greed

Greed is one of the problematic psychological factor that affects trading profitabilty.

Cases like this happen when a crypto trader hodls a coin for a very long time in the hope of selling it off when the price reaches a very high price.

However, as things will likely turn out, the market may go contrary to his expectation causing him a loss of money instead.

- Conduct your analysis

Always conduct both fundamental and technical analysis and DYOR before trading.

Conclusion

I have finally arrived at the end of this post, but before I go, I will like to reiterate this point;

Risk-taking is something inevitable in any investment, therefore, you should never go all in.

Investing all your life savings/crypto portfolio in a single trade comes with two things “Profit and Loss”.

If it is the former, then you are lucky, but the latter has the possibility of ruining your trading career for a lifetime.

Having addressed this issue, I will now like to receive your opinions and questions in the comment box below.

Have you ever lost all your money in a single trade?

What do you think of FOMO & FUD, have you been a victim?

Finally, if you think that these strategies I have shared are helpful, please give it a share by clicking on the social media icon below?

Ps: If you want to learn how to trade cryptocurrencies profitably, we developed a perfect course to help you master Cryptocurrency Trading.

Go to www.ctmastery.com to enrol.

Other Related Articles;

0 Comments