Ever heard of people making money trading something called V75 or Boom and Crash?

That’s the world of Synthetic Indices, a type of trading market that’s becoming super popular, especially among volatility traders.

Born on Deriv in 2013 and fine-tuned ever since. Synthetic Indices are not real-world assets like gold or the dollar.

They’re built by computers to behave like real markets — they go up, down, trend, and even crash.

But they are completely digital, run 24/7, and give you the chance to make profits just by understanding how they move.

In this guide, you’ll learn what synthetic indices are and how to trade them profitably on the Deriv platform.

TL;DR

- Synthetic indices are computer‑generated markets that replicate real‑world price behaviour without being tied to any country, company, or news event

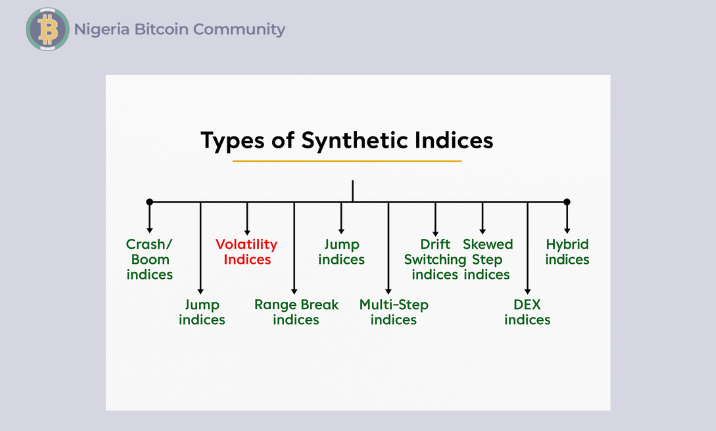

- The big families you will meet are Volatility, Crash, Boom, Step, Range‑Break, Jump, and DEX indices

- They trade 24 / 7 on Deriv, the pioneer and still the deepest venue for synthetics

- Edge = risk control + timing. Treat them like CFDs: size your lots, use stop‑losses, and ride the sessions when your chosen index shows the strongest volatility

- Expect lightning moves and overnight funding costs to be lower than FX, but don’t mistake “synthetic” for “safe” as leverage cuts both ways

Quick Links

- What Are Synthetic Indices?

- Types of Synthetic Indices

- How to Start Trading Synthetic Indices Profitably As a Beginner

- Where to Trade Synthetic Indices

- Synthetic Indices: Big Gains, Big Risks

What Are Synthetic Indices?

Synthetic Indices are markets that are created by computers.

They are not based on real-world currencies, stocks, or commodities

Instead, they follow a specific set of rules and are powered by something called a Random Number Generator (RNG).

Think of it like this:

Imagine a video game where the characters move in a realistic way, even though they aren’t real people.

Synthetic Indices are like that. They behave like real markets with ups and downs, but nothing in the real world (like news or politics) affects them.

Here’s what makes synthetic Indices the go-to for most traders:

| Features | Real Markets | Synthetics |

| Trading Hours | Weekdays | 24/7 |

| Slippage on News | High | None |

| Manipulation Rumours | Frequent | Zero (RNG audited) |

| Volatility Choice | Limited | Dial‑a‑vol (10 – 100 %) |

In summary, Synthetic Indices are preferred by most traders because:

- They move all the time (24/7 availability)

- No news shocks or surprise crashes from politics

- The market patterns are more predictable for technical trader

- You control the market speed by picking how much the price moves (Dial-a-vol 10–100%)

- Also, you can start with small capital

Now let’s look at the different categories. Each one has its own behavior. Understanding them helps you decide which one fits your trading goal

Types of Synthetic Indices

Here are the types of Synthetic Indices available for trading:

1. Volatility Indices (V10, V25, V50, V75, V100)

These are the most popular. Each number shows how “fast” the market moves. For example:

- V75 (Volatility 75 Index) is very fast and active, making it perfect for short-term traders who like action

- V10 is slower and smoother; it’s better for beginners who want more time to decide

These markets go up and down like forex but aren’t affected by world news.

2. Boom and Crash Indices

- Boom 1000 / 500 / 300: The market slowly goes down, then BOOM, it spikes upward suddenly

- Crash 1000 / 500 / 300: The market moves up slowly, then CRASH, it drops suddenly

These spikes happen at random but regular intervals (e.g., 1 spike every 1000 candles in Boom 1000). Traders try to catch these spikes or trade the trend between them.

3. Step Index

This index moves in small, equal steps up or down, making its price action more stable than other synthetic indices.

It’s also highly predictable, which makes it great for beginners testing out strategies or learning how to manage risk without wild price swings.

4. Range Break Indices (Range Break 100 / 200)

These indices move in a tight, sideways range most of the time, then suddenly break out with a sharp move in one direction.

You can trade two ways: capitalise on the calm by trading within the range or wait for the breakout to catch a high-momentum move.

The number (100 or 200) reflects how often the breakout typically occurs; the lower the number, the more frequent the breakouts.

5. Jump Indices (Jump 10, 25, 50, 75, 100)

These indices behave like normal markets most of the time, but occasionally experience sudden, sharp jumps in price, either up or down.

The higher the number, the more extreme and frequent those jumps become. They’re perfect for traders who like surprise volatility and sharp momentum plays.

6. DEX Indices

These indices are designed to replicate the behaviour of decentralised markets, such as crypto.

Their movements are unpredictable and fast-paced, yet still follow fair and transparent logic driven by algorithms.

They’re ideal for traders who enjoy high volatility and rapid price action similar to the crypto market.

They’re best for traders who like crypto-style volatility but not ideal for slow, steady or predictable trends.

7. Daily Reset Indices

These indices reset to a fixed starting point every trading day.

This daily reset creates a repeating structure in their price movement, making their behaviour more predictable compared to other synthetic indices.

They are ideal for traders who rely on pattern-based strategies and want to take advantage of consistent, repeating cycles.

However, they may not be the best choice for traders who prefer riding long trends or trading around the clock, as the reset limits extended price movements.

8. Drift Switch Indices

These indices alternate between two modes: drifting steadily in one direction and moving sideways in a neutral range.

The unique aspect of these indices is the way they switch between trending and ranging behaviour, often without warning.

They are well-suited for traders who can quickly adapt their strategies to changing market conditions.

However, they can be risky for traders who rely on only one trading style, such as always trend-following or always range-trading.

9. Trek Indices

Trek Indices steadily climb or decline over time, with occasional pauses or brief reversals.

Unlike more volatile synthetic indices driven by randomness, these show a clearer long-term direction.

They’re well-suited for traders who prefer riding trends over longer periods.

However, they may not be ideal for short-term scalping strategies that rely on quick, sharp moves.

10. Multi-Step Indices

Multi-Step Indices use a mix of different step sizes, resulting in more complex and less predictable price patterns.

They’re ideal for traders testing advanced strategies or automated bots.

But for absolute beginners, the irregular movements can be confusing and harder to manage.

11. Skewed Step Indices

This is similar to Step Indices, but with a twist; one direction has a higher probability than the other.

For instance, an index might move upward 70% of the time and downward only 30%.

This slight directional bias can be useful for traders looking to build strategies around probability edges.

However, they may not appeal to those who prefer symmetrical, 50/50 movement patterns.

12. Hybrid Indices

Hybrid Indices blend characteristics from different types of synthetic indices, for example, combining elements of Boom/Crash and Step Indices.

This creates more complex price behaviour that doesn’t follow a single, consistent pattern.

Trading them effectively requires careful study and experience, as their mixed behavior can be unpredictable.

As a result, they are best suited for advanced traders who have already mastered simpler index types.

Now that you know the different types of synthetic indices, let’s break down how to actually trade them.

How to Start Trading Synthetic Indices Profitably As a Beginner

1. Understand the Basics of Trading

Learn what trading means, especially in the context of Synthetic Indices.

Put simply, trading means buying or selling an asset (in this case, a synthetic index) to make a profit from its price movement.

Example:

If you believe the price of Volatility 75 Index will go up, you “Buy”.

If you believe it will go down, you “Sell”.

2. Learn to Use the Trading Platform

Familiarise yourself with charts, Buy/Sell buttons, stake size, and Stop Loss / Take Profit settings.

Let’s say you open the Boom 1000 Index chart and spot an uptrend. Here’s how you might set up your trade:

- Stake: $10

- Multiplier: 100x

- Stop Loss: $10

- Take Profit: $15 ( A Risk-to-Reward Ratio (RRR) of 1.5:1)

Then, click UP to enter the trade.

Tip: SmartTrader and Deriv Trader trading platforms are beginner-friendly and ideal for getting started.

3. Learn Market Patterns & Know Your Indices

Synthetic Indices follow price patterns just like forex or stocks, so learning basic market analysis is essential.

Focus on tools like Moving Averages, RSI, and Support/Resistance to understand when to enter or exit trades.

Each index behaves differently; for example, Volatility Indices trend smoothly, Boom/Crash spike suddenly, and Jump Indices move unpredictably.

Knowing how each index behaves helps you choose the right strategy.

4. Risk Management is Critical

Before trading with real funds, understand how to protect your money.

- Never risk more than 2-5% of your capital per trade

- Always use Stop Loss

- Set Take Profit so you exit with a gain

Example: You have $500. You only risk $10 per trade. That way, you can lose 50 times and still be in the game.

5. Keep a Trading Journal

Track every trade:

- Entry & exit points

- Reason for trade

- Result (profit/loss)

- Emotion/lesson learned

Example Journal Entry:

- Date: July 3

- Index: Vol 50

- Entry: Buy at 1290.10

- Exit: 1293.00

- Reason: Bounce off support

- Result: +$2.50

- Lesson: Wait for confirmation next time

6. Join a Trading Community

Trading can feel overwhelming when you’re alone, but joining a supportive community helps you learn faster, avoid common mistakes, and stay motivated.

You get real-time insights, strategy tips, and emotional support from people on the same journey.

Follow Jude Umeano’s YouTube Channel for step-by-step trading guides.

Also, join these active Telegram groups to connect and grow:

If you want to level up faster, start with our premium trading courses designed to take you from beginner to confident trader.

Synthetic Indices are only available through Deriv, a regulated broker that created these indices. Let’s dive into how to start trading on Deriv.

Where to Trade Synthetic Indices

- Sign up at Deriv with email or Google/Apple ID

- Practice with $10,000 demo funds, then fund your Real account when ready to trade live

- Go to “Options” → Choose a platform (SmartTrader, Deriv X, or D-Bot)

- Select an index like Volatility 100 and start trading

Synthetic Indices: Big Gains, Big Risks

While Synthetic Indices can be profitable, they also carry significant risk.

Why people profit:

- Constant movement (24/7)

- No news or outside influence

- Easier to spot trends and patterns

But here’s the risk:

- They move fast, and you can lose fast

- Leverage increases both profit and loss

- Overtrading

Here are proven tips to help you keep winning as you grow.

- Start with Step Index or V10, they’re less volatile

- Avoid V75, Jump 100, or Multi-Step at the start until you are confident as they are highly volatile

- Follow just one or two indices and master their behavior

- Learn how the market moves before risking real money

- Don’t overtrade; instead, trade only when you see a good setup

- Always apply proper risk management strategy

- Take profits regularly. Don’t be greedy

Let’s conclude!

Conclusion

Synthetic Indices open up a new world of trading that’s simple to understand, runs 24/7, and doesn’t rely on news or economic events.

With the right knowledge and risk control, anyone, even a complete beginner, can find their edge.

Want to give it a try? Head over to Deriv and create your free account to start trading.

If you found this guide helpful, let me know in the comments.

And if you know someone who’s curious about Synthetic Indices, share this post with them; it might be just what they need to get started.

0 Comments