On January 31st, 2024, Jupiter Exchange distributed a significant airdrop of their native JUP token, generating widespread interest in the platform.

But what exactly is Jupiter? Beyond airdrops, it’s a powerful liquidity aggregator built on the Solana blockchain, offering smart traders cutting-edge features and efficient token swaps.

In this post, I’ll break down everything you need to know about Jupiter, its potential as an investment, and what the future holds for users.

So, buckle up and prepare for a deep dive into the world of Jupiter!

Post Summary

- What Is Jupiter Exchange?

- Navigating the Jupiter Exchange

- JUP Token Deep Dive

- What The Future Holds For Users: Is JUP A Good Investment?

- Conclusion

What Is Jupiter Exchange?

Jupiter isn’t just another crypto exchange. It’s a decentralized liquidity aggregator built on the Solana blockchain.

It aims to provide efficient and cost-effective swaps for all users.

It achieves this by scanning multiple decentralized exchanges (DEXs) and AMM pools on Solana to find the best possible route for token swaps.

Launched in October 2021, Jupiter has seen impressive growth.

It has processed over $16 billion in transaction volume and facilitated over 9 million swaps, establishing itself as a prominent player in the Solana ecosystem.

But what sets Jupiter apart? Let’s explore its unique features and see what makes it tick!

Navigating the Jupiter Exchange

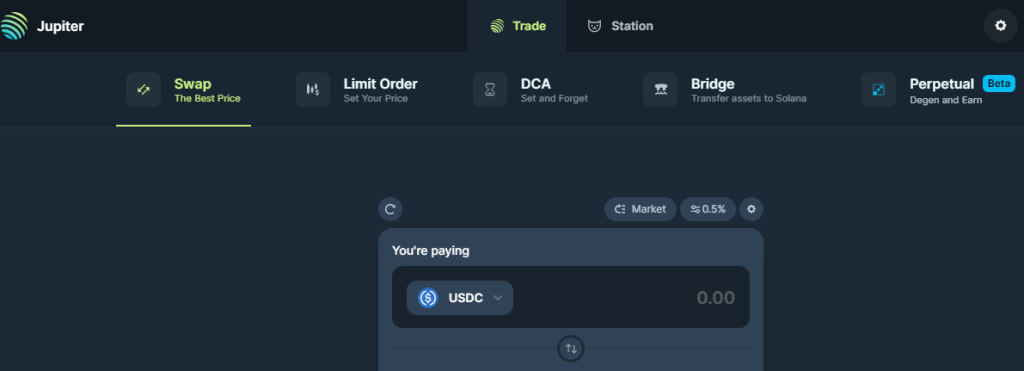

Jupiter Exchange offers a suite of features. Here is what you can do on Jupiter:

i. Swap

Swap enables users to quickly convert their holdings based on market order, take advantage of arbitrage opportunities, or diversify their portfolios.

Jupiter facilitates instant token swaps by scanning 20+ liquidity providers for the best swap rate, streamlining the process for you.

ii. Limit order

Unlike traditional swaps, limit orders allow you to set specific buy or sell orders at desired prices.

These orders are executed automatically when the market reaches your predetermined price point.

iii. DCA

Jupiter makes it more convenient for users to conduct the DCA strategy without having to manually place an order all the time.

DCA, or Dollar-Cost Averaging simplifies acquiring tokens for long-term holding by automatically buying them at regular intervals regardless of the price.

Suppose you want to invest $1000 in Bitcoin. Rather than investing it all at once, you divide it into 10 months, putting in $100 monthly.

This approach allows you to invest gradually and potentially benefit from buying at various price points over time.

Suggested Read: What is Dollar – Cost Averaging(DCA)? | Why You Should Start Using This Investment Strategy

iv. Bridge

This allows you to transfer assets between other supported blockchains and the Solana blockchain seamlessly.

With the “Comparator,” Jupiter swiftly hops multiple bridges, selecting the most suitable one to transfer tokens from various blockchains such as Ethereum, BNB Chain, Base, and others to Solana.

It also leaves you the option to use the Wormhole Bridge to transfer assets to and fro from Ethereum to Solana alone.

V. Perpetual

Futures traders will love this!

This feature allows margin trading on perpetual contracts, essentially speculating on the future price movements of tokens with leverage.

It offers experienced traders the potential for amplified profits (and losses) by magnifying their positions with borrowed funds.

Now, these are the impressive lineup of features that you can explore on the Jupiter Exchange.

As previously mentioned, Jupiter distributed JUP tokens through an airdrop to users who interacted with these features. We’ll explore the JUP token in more detail below.

JUP Token Deep Dive

JUP is the native token of Jupiter Exchange.

It launched on January 31, 2024, through an initial airdrop for users who had used Jupiter Exchange before a snapshot taken on Nov. 2.

There’s a total supply of 10 billion JUP tokens.

50% of the total supply is reserved for community distribution through Airdrops and other initiatives.

The remaining 50% is allocated for team and operational needs, and team allocation is subject to a vesting period starting in January 2025.

JUP fuels the Jupiter ecosystem with these use cases:

- Governance: Holders can use it for governance, participating in decisions that shape the platform’s future.

- Staking: It can be staked to earn rewards and pay trading fees with discounts.

Initial Token Distribution:

Over 4 billion JUP tokens were allocated across four airdrop waves.

However, only 1 billion tokens were distributed for the initial airdrop and were allocated thus:

- 20%: Evenly distributed among all eligible wallets regardless of their interaction level.

- 70%: Allocated based on a scoring system reflecting user engagement on the platform.

- 10%: Reserved for community members and developers.

The remaining three additional airdrops of JUP tokens are planned for January 31st of each year until 2027, totaling 3 billion tokens.

As of February 7, 2024, there are roughly 1.35 billion JUP tokens in circulation.

While the specific details of the remaining 0.35 billion tokens haven’t been publicly disclosed, it’s possible they were allocated to various liquidity pools on the platform to ensure smooth trading functionality.

Want to buy JUP? These are the exchanges to buy it from:

JUP’s long-term value is a common question among token holders. Let’s explore factors that may influence its future worth.

What The Future Holds For Users: Is JUP A Good Investment?

The future looks good!

Jupiter Exchange demonstrated notable resilience, during the recent turbulence experienced by the Solana network.

This is due to the proactive efforts of their team led by Meow, who remained committed to building during those challenging times.

Catch Meow sharing insights into their journey. Well, the fruits of their labour manifested precisely when needed.

Fast forward to today, Jupiter stands as the foremost DApp on the Solana blockchain, according to Dapp Radar as of February 7, 2024.

While, past performance doesn’t guarantee future results, there are compelling reasons why Jupiter and its JUP token investors can anticipate a promising future.

Firstly, Jupiter boasts impressive transaction volume and a user base of over 100k addresses, indicating strong adoption.

This growing community could fuel future token demand.

Moreover, Jupiter’s appeal to big investors is evident, with a remarkable $165 million raised in its fundraising round.

Secondly, as expressed by Meow, the team is dedicated to developing innovative features to address diverse trading needs.

This commitment could significantly contribute to Jupiter’s success, helping it to stay ahead of the curve and attract new users.

Thirdly, the planned future JUP airdrop across three events would likely attract and maintain a vibrant user base and platform activities.

Finally, future integrations and partnerships could further drive the JUP token value.

So, as an investor, you should always hope for the best!

Conclusion

Jupiter Exchange is presently the winning DApp on Solana. Thanks to a dedicated and industrious team.

Also, the platform has generated a lot of attention from its recent JUP airdrop.

Although crypto is unpredictable, Jupiter’s value could keep growing with more adoption and future innovations.

What are your thoughts on Jupiter and its JUP token?

Are you bullish on the project, indifferent to its price growth, or do you have further questions about using the platform? Let me know in the comments!

Remember to share the post by clicking the “SM” button.

0 Comments