In early March 2023, the New York Attorney General, Letitia James, described ETH as a security token.

The news sent ripples through the crypto community, prompting the ubiquitous question: Is Ethereum a security token?

As an ETH holder, it’s important to be aware of the consequences that may arise if a cryptocurrency is labelled as a security token. Recall what happened with XRP. 🥺

In this article, I clarified the misconception about ETH being a security token.

Post Summary

- ETH Labelled A Security: An Overview

- Demystifying ETH

- Security Token Vs Utility Token

- Could ETH Be Considered A Security Token?

- Why ETH Isn’t A Security Token

- What Is The Current SEC Stand On Ethereum?

ETH Labelled A Security

As already hinted at, ETH has been labelled as a security by the New York Attorney General (NYAG), Letitia James.

This happened in a suit filed against one of the largest crypto exchanges, Kucoin, where she alleged that the exchange broke the law by selling unregistered securities, including ETH.

If you recall, this is one of the things we uncovered as some of the reasons why the crypto market was down around March in this article.

This article has a lot to unpack. Let’s ride!

Demystifying ETH

ETH was specifically created as a cryptocurrency to be used as transaction fees on the Ethereum blockchain network.

Before the launch of Ethereum, an Initial Coin Offering (ICO) was held in 2014.

The ICO was used to raise funds for the development of the Ethereum blockchain and to distribute the ETH tokens to investors.

Use-Cases Of ETH

Although ETH’s initial purpose was to function as the network’s gas fee, however, it has now evolved to have multiple use cases. These include:

- Staking

- Liquidity provision

- Collateral

- Crypto trading

- Crowdfunding

- Cross-chain activities

- Payment for goods and services and more

What then could have qualified Ethereum to be classified as a security token, as Letitia James claimed?

Continue below!

Security Token Vs Utility Token

First, to classify ETH, we must understand what security and utility tokens are.

Security Token Explained

Security tokens are blockchain tokens that represent ownership rights in a company or other financial assets such as stocks, bonds, and even real estate.

They are also offered as a form of investment that guarantees returns to investors.

To help you better understand security tokens:

Imagine that there is a thriving company named Gotor.

As it continued to grow, it decided to issue a blockchain token known as GTR to allow anyone to invest in the company.

Now here is the deal:

When an investor buys the token, he becomes a shareholder in the company and is entitled to earn dividends through the company’s profit-sharing. You got it, right?

Security tokens must adhere to specific regulatory compliance requirements before being listed as such.

A token is labelled as a security token if only it passes the Howey test (more details below).

They are also offered through a fundraising mechanism known as STOs (Security Token Offerings).

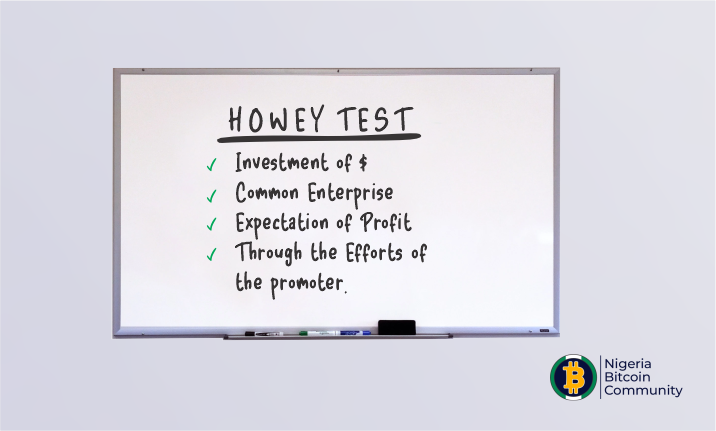

What Is The Howey Test?

The Howey Test is a legal standard applied to any investment to determine whether it is a security or not.

For those who are unfamiliar with the term, the Howey test consists of four parts of tests:

- Investment of money: This means that money has been committed to the investment.

- Common Enterprise: The investment is pooled into a company or an asset

- An expectation of profit: This means that the investor is hoping to make more money from the investment.

- Dependence on others: The success of the investment is tied to the efforts of the company.

That’s all about the Howey test! Does Ethereum pass the test? We will find out about that later. Read on!

Utility Token Explained

Utility tokens are tokens that are created to serve specific functions within a particular blockchain network.

These functions include:

- Payment for gas fees

- Access to applications

- Purchase inventories within a blockchain

- Reward users for contributing to the network

- Payment for real-world values, etc.

Also, utility tokens are offered through an Initial Coin Offering (ICO) or Launchpads.

And unlike security tokens, they are not bound by any regulatory laws and do not provide investors with a guarantee of profit sharing.

ETH, as you know, ticks all these boxes of a utility token. However, you will see below why some critics are putting it up as security.

Could ETH Be Considered A Security Token?

There are a few reasons why critics like Letitia James, consider ETH security.

First, they argue that Ethereum’s ICO positions ETH as a security since investors invested with the hope of making a profit when the network is established.

In other words, the expectation of profit makes ETH security.

The second argument is that of the transition of ETH to proof of stake.

For some critics, the act of depositing ETH to validate and secure the Ethereum network satisfies the first part of the Howey test, which is “investment of money.”

In this regard, they also argued that the majority of investors hold ETH with the mere expectation of receiving staking rewards, which conforms to the “expectation of profit” in the Howey test.

Thirdly, they contend that there is a common enterprise, as all participants on the Ethereum network are working towards the same goal, which is to maintain the network.

Last but not least, they argue that the ETH staking reward is dependent on the efforts of others.

Their reason is that, for investors to earn those rewards, validators on the network must confirm transactions.

While those points aren’t invalid, below is why ETH is not and shouldn’t be considered a security token.

Why ETH Isn’t A Security Token

Kindly read through these few solid points of mine.

- As previously stated, ETH was primarily created to be a utility token and not a security.

- It wasn’t designed to represent ownership in a company or generate profits for investors.

- In addition, ETH’s ICO promised no rewards to investors; it is instead a conventional fundraising system for utility tokens.

- The core profit from ETH is determined by demand and supply and is not reliant on others’ efforts per se.

- Ethereum is completely decentralized; there is no single entity responsible for its development, unlike security tokens

- A large number of merchants and businesses accept ETH as a means of payment, making it a prominent utility token with a real-world use case.

In summary: ETH cannot be classified as security because it’s decentralized and serves a utility purpose.

What Is The Current SEC Stand On Ethereum?

At the time of this writing, April 2023, the U.S. Securities and Exchange Commission (SEC) has yet to make a definitive statement about whether or not ETH is security.

Back in 2018, the SEC director of corporate finance, William Hinman, said, in a remark, that ETH should not be classified as a security because of its decentralized nature. Read his full remark.

However, it is worth noting that Hinman’s remark is not a legally binding statement but a humble opinion.

As a result, it has got the crypto community wondering what the stance of the SEC would be, this time, following the NYGA’s statement.

Part of the reason why this has caused an impending fear is that the SEC chairman, Garry Gensler, had earlier proposed in 2022 that ETH’s shift to proof-of-stake could potentially classify it as a security.

You and I are both aware that if ETH is deemed a security by the SEC, it will have a significant unfavourable impact on the entire cryptocurrency industry.

Well, let’s leave room for optimism and hope that the SEC eventually become lenient.

To sum it up, I will leave you with Gulosven’s words gotten from the Coindesk article:

“I still think it is very unlikely that the SEC is going to declare the current offer and sale of ETH to involve unregistered securities transactions.”

Do you think the same? I would love to know your thoughts in the comment section.

Even though Letitia James’ statement on ETH potentially being security has caused concern, ETH investors are optimistic that regulators will be lenient.

Share this post if you enjoyed it!

0 Comments