Once seen as the play tool of retail traders and crypto maximalists, Bitcoin (BTC) has now made its way into the boardrooms of Fortune 500 companies.

Since 2020, corporate Bitcoin holders have begun accumulating Bitcoin, not just as an investment, but as a strategic reserve asset.

This shift signals growing confidence in BTC’s long-term value—and marks a pivotal moment in the evolution of the crypto landscape.

In this post, we break down the top public companies holding Bitcoin and what this means for the crypto ecosystem.

11 Top Corporate Bitcoin Holders

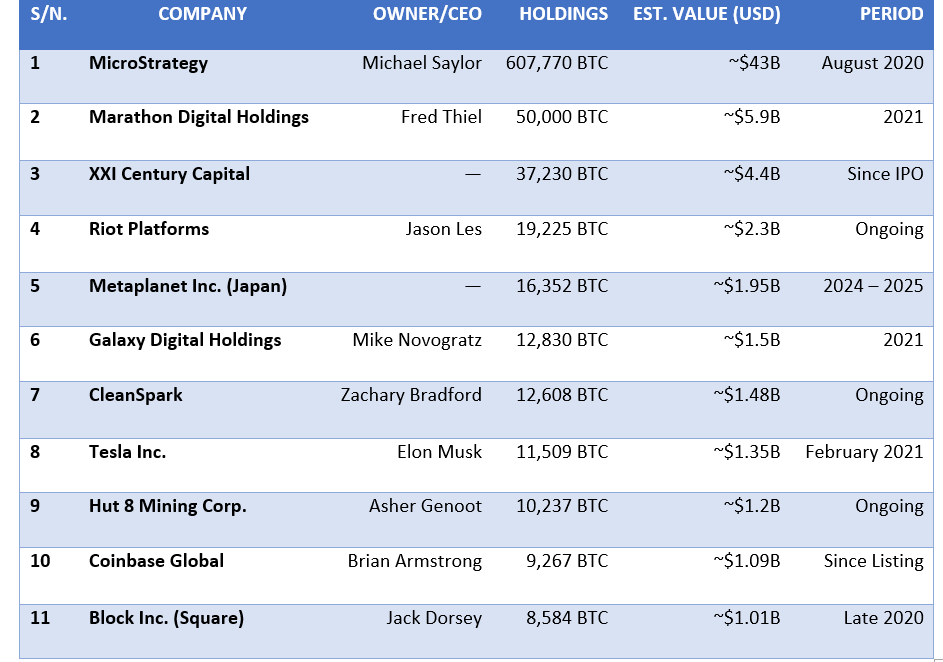

Below is a table showing the top corporate Bitcoin holders, arranged from the largest to the smallest BTC holdings as of July 2025:

1. Strategy

Strategy, formerly MicroStrategy, is a U.S.-based business intelligence firm.

Under the bold leadership of Michael Saylor, it became the first public company to adopt Bitcoin as a primary treasury reserve asset.

BTC Holdings: 607,770 BTC

Est. Value: ~$43 billion

Accumulation Since: August 2020

Why BTC?

Saylor believes that Bitcoin is “digital gold” and a superior store of value compared to cash.

MicroStrategy continues to raise capital—both equity and debt—to acquire more BTC, positioning itself as a “Bitcoin proxy stock.”

2. Marathon Digital Holdings

Marathon is one of the largest Bitcoin mining companies in North America, with Fred Thiel as its CEO.

Unlike traditional miners that sell BTC to cover costs, Marathon chooses to hold a significant portion of its mined BTC.

BTC Holdings: 50,000 BTC

Est. Value: ~$5.9 billion

Accumulation Since: 2021

Why BTC?

Their strategy is straightforward: mine BTC and hold it in the long term to benefit from price appreciation and strengthen their balance sheet.

3. XXI Century Capital

XXI is a crypto-focused investment firm.

It emerged quietly but quickly rose through the ranks with sizable Bitcoin buys, focused on long-term capital growth.

BTC Holdings: 37,230 BTC

Est. Value: ~$4.4 billion

Accumulation Since: Since IPO

Why BTC?

As a Bitcoin-centric firm, it views BTC as both a core holding and product for investors seeking institutional-grade exposure to the asset.

4. Riot Platforms

Riot is a U.S.-based Bitcoin miner focused on large-scale, low-cost mining operations powered by renewable energy.

It has Jason Les as its CEO.

BTC Holdings: 19,225 BTC

Est. Value: ~$2.3 billion

Accumulation Since: Ongoing

Why BTC?

Riot mines Bitcoin at scale and retains a sizable portion, seeing BTC not just as revenue but as a strategic long-term asset.

5. Metaplanet Inc.

A Japanese Web3 and blockchain solutions provider, Metaplanet, pivoted its corporate strategy toward BTC accumulation in 2024.

BTC Holdings: 16,352 BTC

Est. Value: ~$1.95 billion

Accumulation Since: 2024–2025

Why BTC?

Inspired by MicroStrategy’s approach, Metaplanet sees Bitcoin as a long-term reserve asset and hedge against the weakening yen.

6. Galaxy Digital

Galaxy Digital is a leading crypto-focused financial services and investment firm, offering trading, asset management, and advisory services.

Its CEO is Mike Novogratz

BTC Holdings: 12,830 BTC

Est. Value: ~$1.5 billion

Accumulation Since: 2021

Why BTC?

Bitcoin is central to Galaxy’s client services, investment thesis, and treasury model. It aligns with their broader belief in digital assets as an emerging asset class.

7. CleanSpark Inc.

CleanSpark is a sustainable Bitcoin mining company operating in the U.S., committed to using clean energy sources, and has Zachary Bradford as its CEO.

BTC Holdings: 12,608 BTC

Est. Value: ~$1.48 billion

Accumulation Since: Ongoing

Why BTC?

They mine Bitcoin efficiently and hold a growing reserve, betting on future value and supporting decentralization through green mining.

8. Tesla Inc.

Tesla shocked the market in 2021 by investing $1.5 billion in BTC and briefly accepting it for vehicle purchases.

It later sold 75% of its holdings in 2022.

CEO: Elon Musk

BTC Holdings: ~11,509 BTC (estimated)

Est. Value: ~$1.35 billion

Accumulation Since: February 2021

Why BTC?

Musk cited diversification and a hedge against inflation.

Though the company sold most of its stash, it still retains a notable amount.

9. Hut 8 Mining Corp.

It is a top Canadian mining firm known for strong self-mining and HODL strategies, with Asher Genoot as its CEO.

BTC Holdings: 10,237 BTC

Est. Value: ~$1.2 billion

Accumulation Since: Ongoing

Why BTC?

Rather than liquidating immediately, Hut 8 stores much of its mined Bitcoin as a long-term asset, maintaining one of the largest reserves in Canada.

10. Coinbase Global Inc.

Coinbase is the largest publicly traded cryptocurrency exchange in the U.S. and has Brian Armstrong as CEO.

BTC Holdings: 9,267 BTC

Est. Value: ~$1.09 billion

Accumulation Since: Since going public (2021)

Why BTC?

Much of its BTC is customer reserves or treasury, used to maintain liquidity and strengthen corporate backing in crypto-native assets.

11. Block Inc. (formerly Square)

Block is a fintech firm offering Cash App, Spiral, and other BTC-forward products.

BTC Holdings: 8,584 BTC

Est. Value: ~$1.01 billion

Accumulation Since: Late 2020

Why BTC?

Jack Dorsey is a known Bitcoin maximalist. Block integrates BTC into its products and balance sheet, believing it will be the future of money.

Why These Corporate Bitcoin Holders Are Buying BTC

1. Strategic Hedge Against Inflation

With fiat currencies losing purchasing power due to inflation and interest rate fluctuations, many firms now treat BTC as “digital gold.”

2. Institutional Validation

These high-profile holdings legitimize Bitcoin in the eyes of banks, hedge funds, and regulators. It’s no longer just a risky bet—it’s a financial instrument worth serious consideration.

3. Treasury Diversification

Bitcoin offers companies a new way to diversify their reserves beyond fiat, gold, or government bonds.

4. Mining Firms Reinventing Strategy

Firms like Riot and Marathon are not just mining BTC; they are holding it, integrating mining and treasury functions into one operation.

What This Means for the Crypto Verse

i. Market Confidence

Corporate involvement boosts market confidence and reduces the perception of Bitcoin as a purely speculative asset.

ii. Regulatory Pressure

With large corporate holdings, Bitcoin is now under closer scrutiny from regulators.

This may lead to clearer legal frameworks, which could either support or constrain growth.

iii. Increased Liquidity

Increasing the amount of BTC on corporate balance sheets enhances the depth and stability of the market, although it may reduce the circulating supply.

iv. Risk of Centralization

Ironically, decentralized Bitcoin is now increasingly held by centralized entities.

This raises questions about market influence and the centralization of wealth.

Final Thoughts

The fact that publicly traded companies are staking billions of dollars on Bitcoin is a testament to the asset’s maturity.

From Michael Saylor’s bold plays at MicroStrategy to the quiet accumulation by miners and fintech firms, the corporate world is reshaping the narrative around Bitcoin.

As we move deeper into the decade, expect:

- more institutional adoption

- tighter regulations, and,

- a shift in how Bitcoin is used

Not just as an investment, but as a global financial standard.

Whether you’re an investor, developer, or enthusiast, one thing is clear:

Bitcoin is no longer a fringe asset—it’s a boardroom asset.

And if you are new to crypto, don’t worry – I got you covered.

Enroll in our mentorship class and thank me later!

You can also join us on Telegram for coin calls and trade signals.

Help to spread the good news of Bitcoin by sharing this post on your timeline.

0 Comments