In today’s post, I’ll tell you everything you need to know about Bitcoin IRAs.

Bitcoin IRAs meet the purpose of Bitcoin as a store of value.

And it is a good choice if you wish to make cryptocurrency investments for your retirement savings portfolio.

Although it is risky because of crypto volatility, many investors still go for Bitcoin IRAs.

Keep reading to see how it is done.

Quick Access

- Bitcoin IRAs meaning

- How Bitcoin IRAs Work

- Bitcoin IRAs Companies

- Pros and Cons of Bitcoin IRAs

- Conclusion

Bitcoin IRAs meaning

First and foremost, IRAs stand for Individual Retirement Accounts. So, IRAs are accounts where individuals can save long-term for retirement.

In the traditional finance market, there are different types of IRAs with unique perks, but that is beyond the scope of this article. You can read about it here.

IRAs normally allow individuals to invest in different financial products, such as stocks, bonds, ETFs, etc.

The idea is to keep saving and never withdraw until the retirement age of 59.5 years.

Also, IRAs enjoy tax privileges, i.e. they’re charged way less tax than regular investments.

When it comes to Bitcoin IRAs, we’re looking at having an IRA that is based on Bitcoin or other cryptocurrencies.

In other words, you’re saving for your retirement in bitcoin.

So, how does it work? Find out in the next section.

How Bitcoin IRAs Work

To get started, you’ll need to open an account with a custodian that supports Bitcoin IRA.

Also, you may need to provide relevant details like a home address and identity document.

When your account is ready, you can buy Bitcoin from any crypto exchange. Then use it to fund your IRA.

Unsurprisingly, custodians do not owe investors any fiduciary duty concerning Bitcoin IRAs.

Additionally, some IRAs allow you to invest in multiple cryptocurrencies at once.

That said, let’s take a look at some custodians who support Bitcoin IRAs.

Keep reading!

Bitcoin IRAs Companies

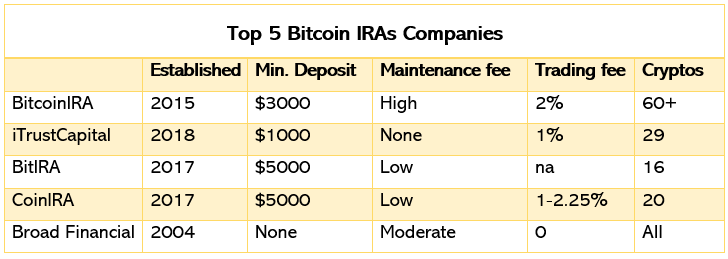

There are several Bitcoin IRA custodians, but I have identified the top five for you based on key factors like fees and supported crypto.

Then I summarized my findings in this table 👇

Also, I briefly explained them below:

a. BitcoinIRA

Top on my list is BitcoinIRA, a large and trusted IRA provider.

It has a user-friendly interface, 24/7 real-time trading, and a mobile app.

Also, BitcoinIRA supports more than 60 cryptocurrencies, including BTC, ETH, XRP, LTC, BCH, ETC.

Furthermore, you can roll over your IRAs from traditional providers on BitcoinIRA.

Additionally, you can leverage the BitcoinIRA Earn feature to lend IRA funds and earn monthly interest income.

The fees charged for opening and maintaining accounts vary based on a user’s initial deposit size.

b. iTrustCapital

iTrustCapital is another Bitcoin IRA provider that made my list.

It allows users to buy and sell crypto & precious metals 24/7 in tax-advantaged IRAs.

Also, users may transfer an existing IRA or open a new account.

Additionally, iTrustCapital uses a regulated, state-chartered trust company to hold IRAs and clients’ assets.

Furthermore, it charges low fees; no setup or monthly fees, and transaction fees are only 1%.

AXS, MANA, BTC, LINK, DOT, and ETH are some of the cryptocurrencies supported on the platform.

c. BitIRA

BitIRA also made my list of the top 5 Bitcoin IRAs.

It was founded in 2017, and the platform is very secure.

BitIRA operates $100 million of end-to-end insurance, cold wallet storage, and multi-factor authorization, among other security measures.

Some supported cryptos are BTC, BCH, ETH, LTC, and XLM.

Moreover, BitIRA charges low fees: a $195 annual fee, a $50 account setup fee, and monthly storage fees of 0.05%.

d. Coin IRA

Brenda Whitman founded Coin IRA in 2017 to enable users to create a Cryptocurrency IRA or an individual non-IRA Custody account.

This platform provides three crypto storage options, namely

- Coin IRA’s offline vault

- A hard wallet e.g. Ledger or KeepKey

- User’s digital wallet.

Also, Coin IRA charges low fees, $0 for account setup, maintenance, and storage, and 1-2.25% for trading.

The minimum requirement for investment is $5,000 and then you can deposit any amount subsequently.

Some supported cryptocurrencies are AAVE, BAT, BTC, BCH, LINK, COMP, DAI, ETH, ETC, LTC, and more.

e. Broad Financial

The last Bitcoin IRA company on my list gives users absolute control of their assets.

You can purchase Bitcoin through an exchange or digital wallet using the model provided by the platform.

Broad Financial offers self-directed IRAs and users can invest in as many cryptocurrencies as possible.

Also, the account setup fee is $1,400, and there is a quarterly fee of $80, but no trading fees are charged.

Now that you’ve seen the different companies that support Bitcoin IRAs, how can you tell if this investment option is right for you?

Read the next section to see the pros and cons.

Pros and Cons of Bitcoin IRAs

Pros

a. It helps to diversify your portfolio beyond conventional bonds, commodities, and stocks.

That way, you avoid the risk of purchasing a single asset.

b. Bitcoin IRAs protect your investment from inflation because Bitcoin and most cryptocurrencies have a fixed supply.

Additionally, crypto is not controlled by governments and central banks, thus protecting your savings from artificial inflation.

c. Selling bitcoin means you’re paying taxes, especially if you’re trading on regulated exchanges.

But bitcoin IRA lets you hold your asset long without paying tax.

d. Given Bitcoin’s history of price growth, basing your IRA on this asset could provide you with high returns on your investment.

However, you will need an effective trading strategy to lock up profits.

Cons

Let’s start with the very obvious, crypto volatility. If upon retirement, the market is low, it will reflect in your Bitcoin IRA, and that would be sad.

Another problem with this type of investment is cost. For most custodians, the minimum deposit for a Bitcoin IRA is above $1,000, which is pretty high. Not to mention fees for account setup, maintenance, and annual contributions.

Gratefully, the pros outweigh the cons. Nevertheless, do due diligence before investing in Bitcoin IRAs.

Conclusion

This is where we’ll draw the drapes in our discussion on Bitcoin IRAs. I hope it was worth your time.

This investment option allows you to save for retirement in Bitcoin or other cryptocurrencies.

Thus granting you maximum returns on your investment while posing the risk of losses based on crypto volatility.

Now, tell me, will you invest in Bitcoin IRAs? Which of the companies mentioned earlier would you use?

Perhaps, you already have a Bitcoin IRA? What has been your experience?

Or do you still have questions on the topic?

Please drop your responses in the comments section, and I will attend to them.

Also, share this article with your friends. Thank you!

0 Comments