Cryptocurrency is an innovative technology that has the capacity to change the global economy as we know it.

While some digital currencies such as Bitcoin have gained immense popularity and value, others continue to remain under the radar.

One such cryptocurrency is AAVE, which has the potential to be a significant participant in the market.

In this blog post, we will examine what makes AAVE unique among other cryptocurrencies and why it could be a worthwhile investment.

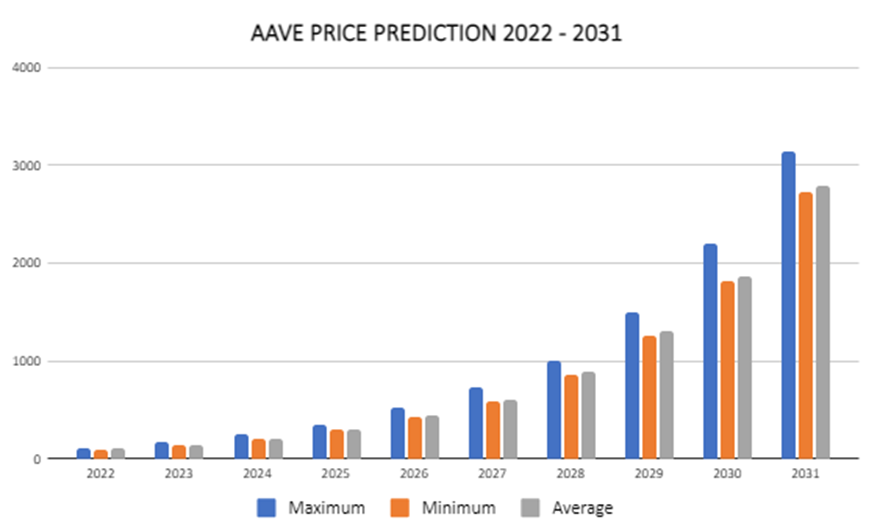

Additionally, we will delve into AAVE price prediction in 2023 and the numerous elements that could influence its future value.

What Is AAVE (LEND) Platform?

AAVE (formerly known as LEND) is a decentralized lending and borrowing platform built on the Ethereum blockchain.

It allows users to lend and borrow a variety of cryptocurrencies in a trustless and decentralized manner.

The platform uses a unique liquidity pool system where users can deposit their assets into a pool and earn interest on them, while other users can borrow from the pool.

The interest rate on loans is determined by the supply and demand of the particular asset in the pool.

In addition to traditional lending and borrowing, AAVE also offers a number of other features such as:

- Flash loans: This allows users to borrow assets for a very short period of time and make high-leverage trades, and

- Credit delegation: This allows users to delegate the creditworthiness of their assets to other users.

AAVE platform also has a native token called AAVE, which is used to govern the protocol and pay for certain transaction fees on the platform.

What Factors Will Influence the AAVE Coin Price in the Future?

There are several factors that can influence the price of AAVE and any other cryptocurrencies in the future, including:

1. Market Sentiment

This refers to the overall attitude of investors towards a particular cryptocurrency.

Positive sentiment can drive the price up, while negative sentiment can drive it down.

2. Regulatory Environment

Government regulations can have a big impact on the price of cryptocurrencies.

For example, a crackdown on illegal activities involving a particular cryptocurrency can lead to a decrease in its price.

3. Economic Conditions

Economic conditions, such as interest rates, inflation, and GDP growth, can affect the demand for cryptocurrencies.

4. Adoption and Usage

The more people use and accept a particular cryptocurrency, the more valuable it is likely to become.

5. Technology Developments

New updates and developments in the technology behind a particular cryptocurrency can also affect its price.

6. Competition

As the crypto market is relatively new, the competition among different cryptocurrencies is intense, and the emergence of new projects, with new features and technology, can affect the price of existing cryptocurrencies.

7. Media Coverage

Media coverage can also play a role in shaping public perception of cryptocurrencies and influencing their prices.

AAVE Price Prediction for 2023

An analysis of AAVE prices in 2023, based on technical analysis, suggests that the minimum cost of AAVE will be $112.34.

The maximum price that AAVE can reach is projected to be $137.26. The predicted average trading price is around $116.02.

According to this analysis, the potential return on investment for AAVE is estimated to be 61.3%.

Where Can I Trade AAVE?

AAVE is a decentralized digital asset, therefore it can be traded on a variety of decentralized and centralized cryptocurrency exchanges.

Some of the popular exchanges that currently list AAVE include:

- Binance: A centralized exchange that allows trading of AAVE against a variety of other cryptocurrencies

- Kraken: A centralized exchange that offers trading of AAVE against other cryptocurrencies and fiat currencies such as USD, EUR, and JPY.

- Uniswap: A decentralized exchange that allows trading of AAVE against other cryptocurrencies using the Ethereum blockchain.

- Aave: AAVE is also available to trade on its own platform.

- Huobi, OKEx, Redot and many more.

It’s important to note that trading on centralized exchanges may require users to go through a KYC (Know Your Customer) process and may also be subject to regulations depending on the jurisdiction in which the exchange operates.

You should also consider the fees, liquidity, and security of the exchange before making a decision.

And before you start trading, you should make sure you understand the risks and have a clear understanding of the trading process.

Conclusion

In summary, technical analysis of Aave prices predicts that the minimum cost of Aave will be $112.34 in 2023 and the maximum price can reach up to $137.26 with the average trading price expected around $116.02.

The potential return on investment for Aave is projected to be 61.3%.

However, it’s important to note that these predictions are not always accurate and there are many factors that can affect future asset prices.

It’s advisable to do your own research and consult financial experts before making any investment decisions.

Disclaimer:

It’s important to note that crypto prices are highly volatile and can be affected by a wide range of factors such as market sentiment, regulatory changes, and global economic conditions.

Also, past performance is not indicative of future results and it would be unwise to rely on technical analysis alone to make investment decisions.

It’s advisable to do your own research, consult financial experts, and diversify your investments.

0 Comments