Most crypto traders spend their time searching for the next coin that will do 100x or even 1,000x. But in reality, consistent profits rarely come from random moonshots. They come from structured signals, disciplined risk management, and precise execution.

Last week, I dropped 14 crypto trading signals. Only three ended in a loss. If you had risked $200 per trade, you could have made approximately $6,344 in one week based on the exact trades we took together.

Post Summary

In this post, I’ll walk you through:

- How I trade crypto signals on WEEX

- My supply and demand zone strategy

- How I calculate position size properly

- How I manage risk using high leverage safely

- How to stack trades using the same capital

- How to qualify for WEEX airdrops and bonuses

Let’s break it down step by step.

Prefer video? Watch the 15-minute walkthrough. Prefer text? Keep scrolling.

🔁 Too Busy to Trade Manually? Use CopyMe

If you don’t have time to calculate entries, manage stop losses, or monitor charts all day, CopyMe solves that.

Simply:

- Connect your exchange

- Set your risk level

- Copy my trades automatically in real time

Same signals. Same risk management. No manual execution.

👉 Activate CopyMe and let the trades execute for you—Join the Waitlist.

Why I Trade Signals on WEEX

One major reason I use WEEX is its ability to stack trades efficiently.

Stacking allows you to use the same capital to open multiple positions without interfering with each other. This maximizes capital efficiency and gives you better flexibility when managing trades.

Other benefits include:

- High leverage availability

- Separate position management

- Built-in earning options

- Airdrop participation through WE Launch

Understanding the WEEX Account Structure

Before trading, you need to understand how funds are structured on WEEX.

Your account is divided into three sections:

– Futures Account

Used for futures trading (long and short positions with leverage).

– Spot Account

Used for buying and holding cryptocurrencies.

– Funding Account

This is where deposits arrive before being transferred to futures or spot.

If you want to trade futures, simply transfer funds from Funding to Futures.

If you want to trade spot, transfer funds to Spot.

When you make profits, you can move them back to funding.

How to Qualify for WEEX Airdrops (WE Launch)

WEEX offers airdrops through its WE Launch program.

To qualify:

- Buy at least 1,000 WXT tokens (approximately $34)

- Hold them in your account

- Commit them inside the WE Launch section

Once committed, you qualify for upcoming airdrops such as ChainGuard and other listed projects.

This is a simple way to earn additional rewards while trading.

👉 Activate CopyMe and let the trades execute for you—Join the Waitlist.

My Trading Strategy: Supply and Demand Zones

Now let’s talk about how the trades are actually taken.

I primarily use:

- Breakout structures

- Supply zones

- Demand zones

- Multi-timeframe analysis

Step 1: Identify Breakout Structure (4H Timeframe)

On the 4-hour chart, I look for breakout structures. After a breakout, price often retraces before continuing its move.

When I see this, I anticipate:

- A retracement into a supply or demand zone

- A reaction from that zone

- Continuation in the expected direction

Step 2: Refine on Lower Timeframes (1H, 15M, 5M)

After identifying the larger structure:

- I drop to 1H to identify key zones

- Then refine entries on 15M or 5M

- I mark precise supply and demand areas

This gives me tighter entries and better risk-to-reward ratios.

Example: HBAR Short Trade (4.5R Setup)

Let’s break down a real signal.

- Trade: HBAR short

- Risk-to-reward ratio: 4.5

- Risk: $20

- Potential reward: $90

If the trade loses → lose $20

If the trade wins → gain $90

That’s controlled risk with strong upside.

👉 Activate CopyMe and let the trades execute for you—Join the Waitlist.

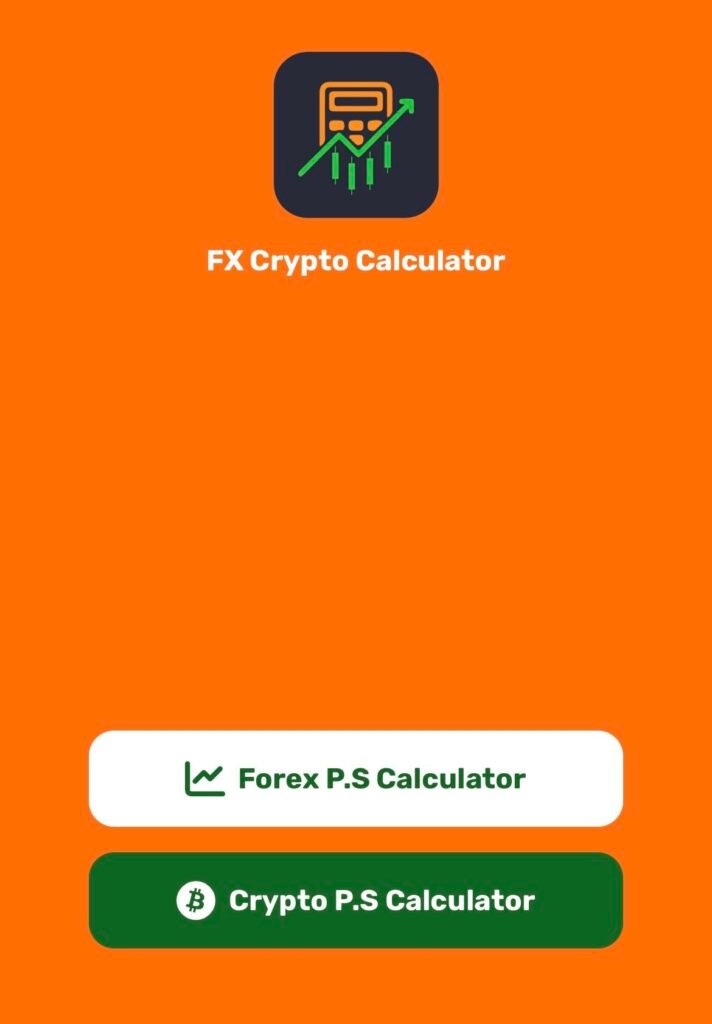

How to Calculate Position Size Properly

This is where most traders make mistakes.

They think:

“If I want to risk $20, I’ll just enter $20.”

That’s wrong.

Instead, you must:

- Use a position size calculator (crypto mode)

- Enter your capital (e.g., $500)

- Set your risk amount ($20)

- Input entry price

- Input stop-loss price

- Copy the calculated position size

The calculator gives you the correct position size based on your defined risk.

Leverage does not change your risk. Your position size does.

How to Execute the Trade on WEEX

Inside the Futures section:

- Select the trading pair (e.g., HBAR)

- Set leverage (I use high leverage but manage risk strictly)

- Choose Limit Order

- Make sure:

- Amount is set to USDT

- Order by cost is unchecked (use order by value)

- Paste the calculated position size

- Enter your entry price

- Under Advanced:

- Input Take Profit

- Input Stop Loss

Once confirmed:

- Click Open Short (if shorting)

- Click Open Long (if longing)

If done correctly:

- Your maximum loss equals your predefined risk

- Your potential gain matches your calculated reward

Don’t Want to Trade Manually? Let CopyMe Do the Work

Reading through this and thinking,

“This looks good… but I don’t have time to calculate entries and position sizes every day”?

That’s exactly why CopyMe exists—join the Waitlist.

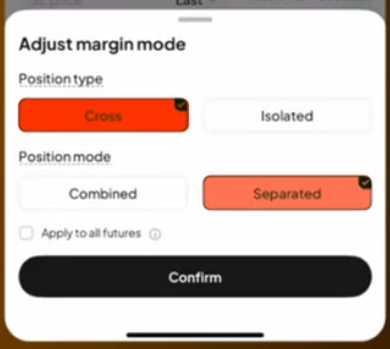

How I Stack Trades on WEEX

Stacking is one of the most powerful features.

Here’s how it works:

- Enter Trade #1 risking $20

- Price moves in your favor

- Market forms another structure (e.g., Fibonacci 0.62 retracement)

- Enter Trade #2 — also risking $20

- Move stop-loss of Trade #1 to break even

Now:

- Trade #1 is protected

- Only Trade #2 carries risk

- Both positions are recorded separately

This is why you must use:

- Cross margin

- Separated position mode

On many exchanges, positions merge. On WEEX, they stay independent.

This allows better control and safer scaling.

👉 Activate CopyMe and let the trades execute for you—Join the Waitlist.

Risk Management: The Real Secret

The reason 14 signals produced strong weekly results wasn’t luck.

It was:

- Strict risk control

- Defined stop-loss

- High R:R setups (4R–6R)

- Small losses

- Larger wins

When you structure trades like this:

- A few losses don’t matter.

- Winners pay for multiple losers.

That’s how $6,344 becomes realistic with disciplined execution.

Conclusion

Most traders chase 100,000% moonshots.

But real, repeatable income in crypto comes from:

- Structured signals

- Proper position sizing

- Supply and demand analysis

- High risk-to-reward setups

- Strategic stacking

- Strict risk management

If you focus on execution instead of hype, consistent profitability becomes possible.

Trade smart. Manage risk. Let probability work in your favor.

And if manual trading isn’t your thing, secure your spot on the CopyMe waitlist now.

0 Comments