Have you been looking for the best on-chain platforms for trading crypto derivatives?

Perpetual decentralized exchanges (Perp DEXs) have become a powerful force in crypto trading.

As more traders move away from centralized exchanges, the demand for fast, trustless, and transparent trading grows.

But with so many new perp platforms popping up, which ones actually stand out?

This post breaks down the top 5 perpetual DEXs in 2025 based on trading volume, user experience, innovation, and ecosystem growth.

Whether you’re a beginner or an experienced trader, this guide will help you choose the best platforms to explore.

What Are Perpetual DEXs?

Perpetual DEXs (Decentralized Exchanges) are blockchain-based platforms that enable trading of perpetual futures contracts, also known as perpetual swaps, without intermediaries.

Unlike traditional futures contracts, perpetual contracts have no expiration date, allowing traders to hold positions indefinitely as long as margin requirements are met.

These platforms operate on decentralized networks, using smart contracts and automated market makers (AMMs) to facilitate peer-to-peer trading, ensuring transparency, non-custodial fund control, and global access without KYC requirements.

Compared to centralized exchanges like Binance, Perpetual DEXs offer more freedom such as no KYC requirements, non-custodial control, and full ownership of your funds.

Top 5 Perpetual DEXs to Trade Safely and Profit On-Chain

How We Picked the Top 5

We selected these protocols using a mix of:

- 24h and weekly trading volume

- Liquidity and number of supported assets

- User interface and ease of use

- Innovative features

- Ecosystem support and real adoption

| DEX | Chain / Infra | Daily Volume | TVL | Active Traders | Token | Trading Experience |

| Hyperliquid | Custom Layer 1 | ~$1B+ | ~$200M | ~130K weekly | $HYPR | Gasless, CEX-like UI, no wallet required |

| Aevo | OP Stack Rollup | ~$400M | ~$80M | ~60K monthly | $AEVO | Advanced UI, supports both perps and options |

| dYdX v4 | Cosmos AppChain | ~$1.2B | ~$450M | ~90K monthly | $DYDX | Fully on-chain order book, institutional-grade UI |

| Drift Protocol | Solana | ~$300M | ~$100M | ~40K weekly | $DRIFT | Ultra-low latency, integrated with Solana wallets |

| Vertex Protocol | Arbitrum | ~$250M | ~$70M | ~35K monthly | $INK | Hybrid CLOB + AMM, unified balances, cross-margin |

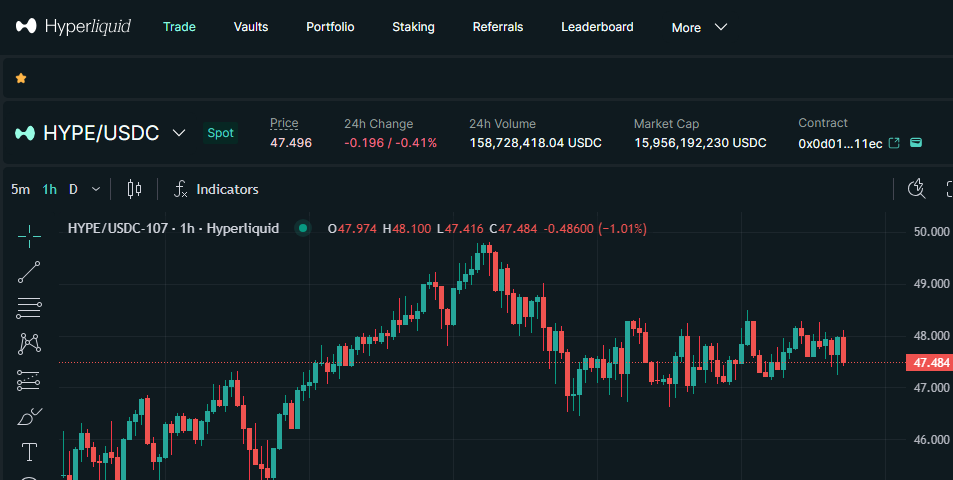

1. Hyperliquid

Hyperliquid is one of the fastest-growing perpetual DEXs, supporting over 100 assets including BTC, ETH, SOL, AVAX, and popular memecoins like PUMP and POPCAT.

Built on its own custom Layer 1 blockchain, it delivers high-speed, gasless trading offering the feel of a centralized exchange while remaining fully on-chain.

Founded in 2022 by Jeff Yan, a former co-founder of Chameleon Trading, Hyperliquid emerged after the FTX collapse to fill the gap for a high-performance, decentralized derivatives exchange.

Traders can access up to 50x leverage on perpetual futures, allowing them to control large positions with minimal capital (for example, $1,000 can control $50,000).

There are no gas fees on trades only for deposits and withdrawals via the Arbitrum bridge for USDC. Trading fees remain low at 0.045% for makers and 0.015% for takers, with a 0.2 bps maker rebate.

It also supports USDC bridging from Arbitrum, Ethereum, and Solana through bridges like Synapse, HyBridge, and the native Arbitrum Bridge.

Why It Stands Out:

- Gasless, wallet-free onboarding

- On-chain order book with super low latency

- Strong trader community with frequent competitions

- LP vaults for passive income

Best For: Day traders, degen scalpers, and users who want CEX speed on-chain

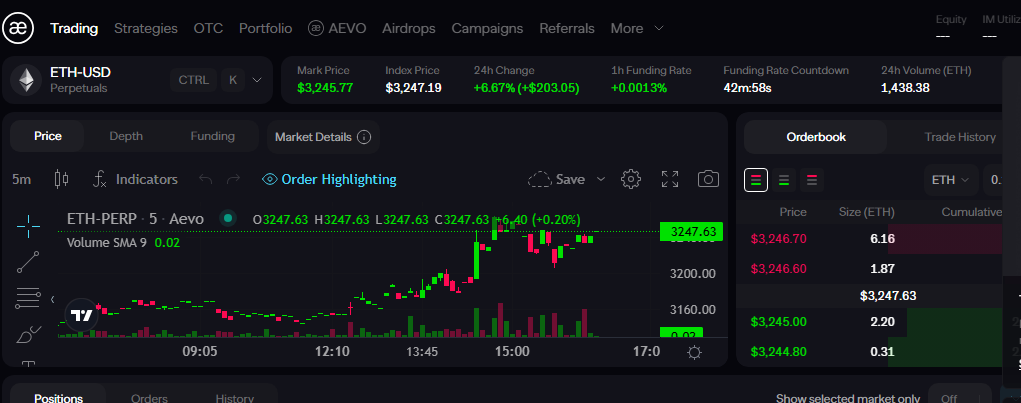

2. Aevo

Aevo is a decentralized derivatives exchange built on a custom Ethereum Layer 2 using the Optimism Stack.

It offers perpetual futures (up to 20x leverage), options settled in USDC, and pre-launch token trading, all with no gas fees for trading.

Aevo aims to combine CEX-level speed with DeFi-level transparency and security.

Its standout pre-market feature lets users trade tokens before they officially launch.

The platform is backed by top investors like Paradigm and Coinbase Ventures, and its team includes talent from Coinbase, Kraken, and Goldman Sachs.

Trading fees are low, and deposits can be made via Ethereum, Optimism, or Arbitrum.

Why It Stands Out:

- Clean UI for pro traders

- Advanced tools for both perps and options

- OP Stack performance with Ethereum security

- Regular reward programs

Best For: Experienced traders looking for advanced strategies.

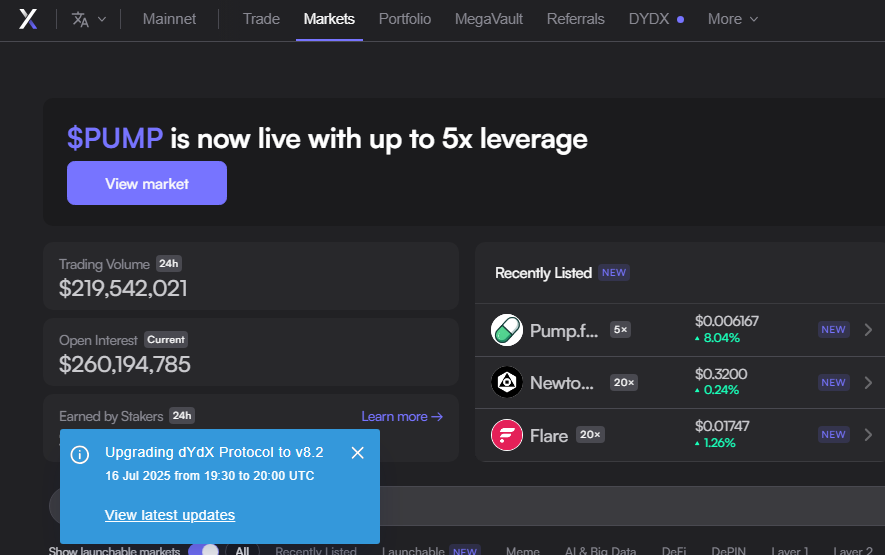

3. dYdX

dYdX is a decentralized exchange for trading perpetual futures.

It runs on its own blockchain called the dYdX Chain, which helps make it faster and fully community-controlled.

Unlike the older version, it no longer depends on Ethereum and removes all centralized parts.

Traders can place different types of orders (like market or limit) and trade over 140 crypto assets with up to 50x leverage.

Only matched trades cost gas, and trading fees are low; 0.02% for makers and 0.05% for takers.

With fast speed and no central control, it gives users a CEX-like experience in a truly decentralized way.

Why It Stands Out:

- Order book lives fully on-chain

- Deep liquidity from institutional users

- Zero gas fees

- Proven track record and large trader base

Best For: Traders who want decentralization + professional execution

4. Drift Protocol

Drift is a popular decentralized exchange on Solana that focuses on perpetual futures and other trading features like spot swaps and lending.

It offers fast, low-cost trading with a smooth user experience, similar to centralized exchanges.

Traders can use up to 10x leverage on most assets, and up to 101x on ETH with zero fees.

You can also use over 30 tokens as collateral and trade with cross-margin to reduce the risk of liquidation.

There are no gas fees for trading, and fees are low just 0.02% for makers and 0.05% for takers.

Drift is one of the top trading platforms in the Solana ecosystem with high volume and strong user activity.

Why It Stands Out:

- Lightning-fast execution

- Multiple trade types (market, limit, TWAP)

- High APY vaults for liquidity providers

- Native integration with Solana wallets

Best For: Solana-native users and active traders looking for speed.

5. Vertex Protocol

Vertex is a decentralized exchange that lets users trade spot and perpetual futures on one platform with a fast, CEX-like experience.

It started on Arbitrum and expanded to nine blockchains like Base, Blast, and Mantle through Vertex Edge, which enabled cross-chain trading using a shared liquidity pool.

The platform combines an order book and AMM to keep trades fast, low-cost, and efficient, with access to 50+ markets and up to 50x leverage.

Users who staked the VRTX token earned a share of trading fees across supported chains.

In July 2025, Vertex announced it is sunsetting Vertex Edge and transitioning to the Ink Foundation, with its core infrastructure and team moving under the Ink L2 ecosystem.

As part of this migration, the VRTX token will be phased out, and eligible holders will receive INK tokens via an airdrop.

Users are advised to close all positions and withdraw funds by July 14, 2025, to avoid forced settlement.

Why It Stands Out:

- Centralized matching engine with DeFi benefits

- Unified wallet balances

- Great capital efficiency

- Token incentives still active

Best For:Traders who want fast execution, deep cross-chain liquidity, and a seamless CEX-like experience without giving up self-custody.

While these are the leading perpetual DEXs,Other notable platforms include:

– Paradex

– Avantis

Avantis is an innovative perp DEX aiming to remove oracles and bring full on-chain pricing.

It supports trustless trading with a unique design and is ideal for advanced traders looking for a new kind of system.

Why It’s Interesting: Oracle-less perps, capital-efficient engine, and a fresh take on DeFi derivatives.

Conclusion

The competition in the perp DEX space is heating up fast. Traders want speed, deep liquidity, and new tools but they also want to stay in control of their assets.

The platforms listed here show what’s possible when decentralization meets smart design.

From high-volume giants like Hyperliquid and dYdX, to newer innovators like Avantis and Paradex, there’s a place for every kind of trader.

Which one is your favorite?

Are you trading on any of these platforms? Have a hidden gem we missed?

Share your thoughts in the comments box below.

If you’re looking to explore opportunities beyond crypto, Synthetic Indices have quietly become a go-to. Learn how traders are flipping small balances into daily profits by trading Synthetic Indices

0 Comments