The crypto space continues to evolve, offering new ways to engage with markets beyond traditional trading.

One of the standout innovations is Limitless Exchange, a decentralized prediction market built on the Base network.

Unlike typical DEXs or perpetual trading platforms, Limitless doesn’t offer spot or leverage trading.

Instead, it allows users to place fixed-odds predictions on crypto price movements and other events, with the potential for high returns if their predictions are correct.

In this article, we’ll break down how Limitless Exchange works, what makes it different from platforms like Polymarket, and why it’s becoming a favorite among traders looking for on-chain prediction opportunities.

Want real-time trading tips and updates?

Be part of our growing Telegram family of traders!

👉 Click to join Afibie Trades

What Makes Limitless Exchange Different?

Limitless Exchange is a decentralized prediction market built on the Base network.

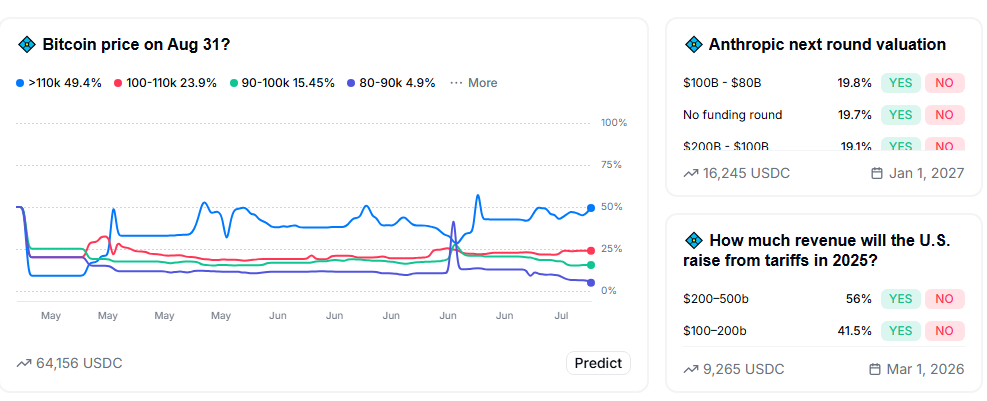

It offers users a new way to express market opinions, not by trading perps or spo,t but by placing yes/no predictions on future outcomes.

Here’s what sets it apart:

- Bet on Outcomes: Predict events like “Will ETH be above $4,000 by the end of the month?” using simple yes/no markets

- Fixed Risk, Fixed Reward: Unlike perpetual trading, there’s no margin or liquidation; you risk only your chosen stake, and payouts are predefined

- Built on Base Network: Fast, low-fee transactions with full on-chain transparency

This model is different from traditional crypto platforms like DEXs or Perp DEXs.

Instead of managing positions or worrying about stop-losses, you simply bet on outcomes and either win or lose your stake, making it more like a crypto-native alternative to betting or a prediction game.

Traditional DEXs: What’s the Problem?

Limitless vs. Traditional DEXs

| Feature | Traditional DEXs | Limitless Exchange |

| Platform type | Spot/perpetual trading | Prediction market |

| Liquidation risk | Yes (in leveraged/margin trades) | No (fixed-risk prediction model) |

| Oracle dependency | Often required for price feeds | Limited (used only for market resolution, not for pricing) |

| Asset coverage | Limited to listed trading pairs | Any asset/event with a market created |

| Trader protection | Low (subject to volatility and slippage) | High (no leverage, no liquidation. You only risk the amount paid for the position) |

Traditional decentralized exchanges (DEXs) are designed for spot and sometimes perpetual trading.

They operate using liquidity pools or order books, and allow users to trade crypto assets directly on-chain.

But here’s the challenge:

When trading with leverage or on perp DEXs, you risk liquidation.

If the market moves against your position and your margin runs out, the platform forcefully closes your trade.

This often leads to losing your entire position, even from small price moves during volatile times.

On Limitless Exchange, you don’t get liquidated because there’s no leverage involved at all.

Instead of borrowing or risking margin calls, you simply buy a “Yes” or “No” token representing a specific outcome.

Your maximum loss is limited to the amount you pay for that token, and you never have to worry about forced liquidations no matter how volatile the market gets.

This fixed-risk model makes Limitless different from traditional trading platforms, and even more flexible than many prediction markets.

To better understand how Limitless stands out, let’s compare it with Polymarket, one of the most established prediction markets in crypto.

What Is Polymarket and How Is It Different?

Polymarket is one of the most established decentralized prediction markets in crypto.

It allows users to place bets on real-world events like elections, sports outcomes, or even cultural topics.

The platform runs on Polygon and is known for its use in information markets, where traders speculate on the outcomes of non-financial global events.

Key Differences Between Polymarket and Limitless Exchange

| Feature | Polymarket | Limitless Exchange |

| Focus | Real-world event predictions (elections, sports, politics) | Crypto-native and real-world event markets |

| Blockchain | Polygon | Base (Ethereum Layer-2) |

| User Base | General public, forecasters | Crypto traders, DeFi users, speculative bettors |

| Leverage | None | None |

| LP Model | No direct LP exposure to volatility | LPs use Uniswap V3 to provide liquidity, which can involve impermanent loss |

| Market Type | Binary prediction markets only | Binary markets, designed to mimic trading-style decisions |

Want real-time trading tips and updates?

Be part of our growing Telegram family of traders!

👉 Click to join Afibie Trades

How to Predict or LP to Earn on Limitless

Limitless is designed to be easy to use for both traders and liquidity providers.

Whether you want to bet on future outcomes or earn money passively as an LP, here’s how to get started.

How to Predict on Limitless

Prediction on Limitless means you are buying a “yes” or “no” share based on what you think will happen.

Steps:

- Connect your wallet

- Go to the Limitless Exchange and connect your wallet

- Choose a market

- Look at the available prediction markets. For example: “Will BTC be above $109,000 by July 31?”

- Buy ‘Yes’ or ‘No’

- If you believe the outcome will happen, buy “Yes.” If not, buy “No”

- The price of each share shows the market’s current belief. For example, if “Yes” is $0.30, that means a 30% chance

You can hold your position until the market settles or sell it early if the price moves in your favor.

If your prediction is right, you’ll receive your payout when the market closes.

How to Provide Liquidity (LP) on Limitless

Limitless lets you earn fees by supplying liquidity to its prediction markets. Here’s how:

Steps:

- Add Liquidity via the Limitless Exchange

- Deposit tokens like ETH or USDC into a liquidity position. This uses Uniswap V3 under the hood, but everything happens within Limitless.

- Choose a Strategy and Deploy

- Select a strategy, confirm your position, and it will automatically create and register it

- Start Earning Fees

- Once active, your position helps power markets, and you’ll earn fees as traders interact with your liquidity range

As long as traders are using your liquidity, you’ll keep earning premium fees in return.

You’re also free to withdraw your funds anytime, with rewards automatically added to your wallet.

Conclusion

Limitless Exchange is a new DeFi platform where traders buy “Yes” or “No” tokens on real-world outcomes.

It offers:

- Real-money prediction markets with clear risk/reward

- Fee-earning opportunities for LPs via Uniswap V3

- A more advanced, trader-focused alternative to Polymarket

Compared to Polymarket or traditional DEXs, Limitless is more complex but also more rewarding.

If you’re looking to explore opportunities beyond crypto, Synthetic Indices have quietly become a go-to. Learn how traders are flipping small balances into daily profits by trading Synthetic Indices.

Let me know what you think about the exchange in the comments, and feel free to share this post with others!

0 Comments