Most traders spend months cramming their heads with pin bars, dojis, spinning tops, engulfings, and every candlestick name under the sun.

But here’s the truth: 90% of those patterns don’t work on their own.

Instead of memorizing a dictionary of candles, you only need three proven candlestick patterns.

When used in the right market context, these patterns can give you sniper-like trade entries.

In this post, you’ll learn:

- The top 3 candlestick patterns that actually work

- How to spot them, and

- How to combine them with supply and demand zones for higher-probability trades.

Let’s dive in at once.

3 Candlestick Patterns That Work

1. The 3-Bar Reversal

This is one of the most underrated candlestick patterns — and it works because it shows a shift in momentum.

Here’s how it looks:

- First candle: Strong momentum in one direction.

- Second candle: Rejection of that move (small body or long wick).

- Third candle: Confirmation of the reversal.

This structure is sometimes called a Morning Star (bullish), Evening Star (bearish), or a simple 3-Bar Reversal.

The secret?

Location matters more than appearance.

If the reversal happens randomly in the middle of the chart, ignore it.

But if it forms at a key supply or demand zone, after a Break of Structure (BOS) or a liquidity sweep, it becomes a powerful setup.

When you catch this pattern in the right spot, you’re often entering just before the wider market sees what’s happening.

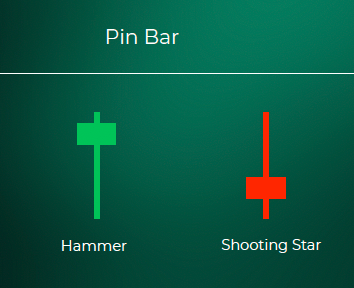

2. The Pin Bar (Liquidity Trap)

The Pin Bar (also called a Hammer when bullish, or Shooting Star when bearish) is one of the most famous candlestick patterns.

But here’s the mistake: most traders trade it anywhere on the chart.

A real pin bar indicates that liquidity is being trapped and rejected.

- Small body

- Long wick (the wick tells the story)

This wick shows where the market reached for liquidity, swept orders, and then completely rejected that price.

The best pin bars form at supply or demand zones, right after a liquidity grab, and confirm a structural break.

Sometimes, the pin bar even becomes part of a 3-Bar Reversal setup, making the signal even stronger.

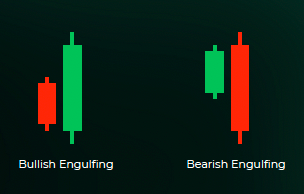

3. The Engulfing Pattern

The Engulfing pattern is one of the cleanest confirmations you can get.

- A Bullish Engulfing forms at the bottom of a downtrend, when buyers suddenly take over and wipe out the previous candle.

- A Bearish Engulfing forms at the top of an uptrend, when sellers step in aggressively and flip the sentiment.

Why it works is that it shows a complete takeover of momentum.

But just like the other patterns, context is everything.

On its own, it’s noise.

At the right zone, after a BOS or liquidity sweep, it’s a sniper entry.

Bonus: How to Draw Supply & Demand Zones (The Right Way)

Most traders fail not because of bad candlestick reading, but because they draw supply and demand zones incorrectly.

Here’s a clean 4-step process:

- Start with a Break of Structure → signal of a shift.

- Find the original candle that caused that break.

- Last bullish candle before a strong drop = supply.

- Last bearish candle before a strong rally = demand.

- Check for a Fair Value Gap (FVG) after that move. If there’s an imbalance, the price may come back.

- Mark the entire candle (body + wick) as your zone.

Then wait for the price to return to that zone.

Once it does, look for one of the three candlestick patterns (Reversal, Pin Bar, Engulfing) as confirmation before entering.

Keep zones simple and precise. If your zones are messy, your trades will be messy.

Final Thoughts

Candlestick patterns are powerful, but only if you stop memorizing dozens and focus on the ones that work:

- 3-Bar Reversal

- Pin Bar (Hammer/Shooting Star)

- Engulfing

Used alone, they’re weak.

Used in the right context — with Supply & Demand, Break of Structure, and Liquidity Sweeps — they become high-probability trading tools.

Now, over to you:

What’s your go-to candlestick pattern?

Drop it in the comments below, let’s see if it makes the top 3.

You can also join our mentorship session, where we teach traders how to combine these setups with proper market structure analysis.

This way, you can stop gambling and start trading with confidence.

See you there!

0 Comments