Are you a faithful trader (or investor) who’s always looking for new ways to earn more profit?

Kudos! you are on the right page.

In today’s post, I will show you how to buy low or sell high at a desired future price and date.

You will see how the above is achieved using Binance Dual Investment.

Next, I’ll discuss with you how dual investment with Binance works, its benefits, how to get started, and most importantly, the risks involved.

Before we cut deep into the meat of the topic, let’s highlight important points featured in this post:

Key Points

- What is Binance Dual Investment?

- How Does It Work?

- Benefits Of Binance Dual Investment

- How To Subscribe To Dual Investment

- How are the returns calculated?

- Associated Risks.

- Conclusion.

Let’s begin clearing our doubts on the subject matter.

1. What Is Binance Dual Investment?

Binance Dual Investment is one of the multiple features of Binance to aid traders (and investors) maximize profit in their crypto trading journey.

It provides an opportunity to buy or sell any cryptocurrency at a desired price and date in the future.

What’s more, you also get to earn a high-interest yield whether the market is rising or falling.

Binance Dual Investment is more or less an automatic trading feature, but with the additional bonus of earning while hodling your assets.

As an investor or trader with a Binance account that wants to do more than stake or lend your HODLed coins, Dual Investment can be a good way to diversify.

Now we know what it is, now let’s look at what goes on behind the scenes.

2. How Binance Dual Investment Works.

There are two types of Binance Dual Investment products – “Buy Low” and “Sell High“.

Below, I’ll try to break it down with a simple story:

Here, we’ll call our crypto trader, Tom.

As of January 1st, Tom had 1BTC that he wished to sell for $50,000 within 30 days.

He subscribes to a Sell High BTC Binance Dual Investment plan with a target price of $50,000 and a settlement date of January 31st.

Also, Tom is entitled to 40% APY (Annual Percentage Yield) from this dual investment subscription.

On the settlement date, Tom expects two possible scenarios to play out:

- Firstly, the current BTC price is not up to Tom’s target price of $50,000. In other words, no trade is made and Tom still gets to keep his 1BTC and earns 0.033 BTC from the 40% APY (Annual Percentage Yield).

- Secondly, the market price reaches Tom’s target price and he sells his 1BTC with an interest of 0.033BTC at the target price of $50,000, making a total of 51.650 BUSD.

The above scenario also applies to the Buy Low dual investment plan, except it allows Tom to buy BTC using his stablecoins.

Note that for Binance Dual Investment, you cannot cancel your subscription or redeem your investment until your settlement date.

So, why should you invest with Binance for this? 👇

3. Benefits Of Binance Dual Investment

- You can buy crypto at a lower price or sell it at a higher price.

- You earn a high passive income despite the direction of the market (high or low).

- Also, you have the option to choose from a wide variety of assets and set the target date of your choice.

- Above all, with Binance Dual Investment, buying low and selling high is done with zero charges. 😎

So, how do you get started? Answers coming right below:

4. How to Subscribe to Binance Dual Investment

You can go ahead and check out this video on how to do that or scroll down to read through.

1. Log in to your Binance account and click Earn then select Dual Investment from the dropdown window.

Note that it is set to Beginner Mode by default. The mode is designed for new Dual Investment users. It provides a step-by-step guide for easy navigation.

However, you can turn on/off this feature by toggling the button next to Beginner Mode.

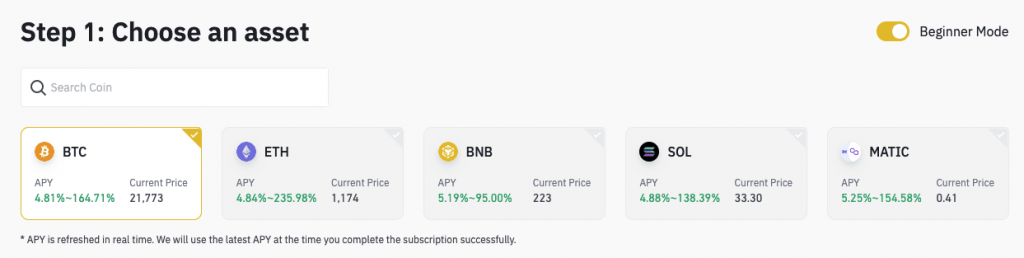

2. Secondly, search for the crypto you wish to Buy Low or Sell High. You’ll see the APY for the asset and its current market price. Click on the asset to start.

3. Before you proceed, complete the Dual Investment quiz if this is your first time using the product.

4. Decide to Buy Low or Sell High.

5. Select a Target Price and Settlement Date.

6. Enter your subscription amount, agree to our terms, and click [Subscribe].

7. At this point, you’re all set!

Your funds will be settled within 6 hours after the Settlement Date checkpoint time (08:00 UTC).

5. How Are The Returns Calculated?

For our Interest income, we can calculate that using the formula below:

Interest Income = Subscription Amount x APY% x Subscription Period (in days) / 365

Buy Low Returns

Two possible scenarios on the Settlement Date:

- Target Price is reached: (Subscription Amount + Interest Income) / Target Price

- Target Price is not reached: Subscription Amount + Interest Income

Sell High returns

Two possible scenarios on the Settlement Date:

- Target Price is reached: (Subscription Amount + Interest Income) * Target Price

- Target Price is not reached: Subscription Amount + Interest Income

On every Settlement Date, Binance uses 08:00 UTC as the checkpoint to decide whether the Settlement Price has reached the Target Price or not.

The Settlement Price is the market price average in the 30 minutes before 08:00 UTC on the Settlement Date.

As mentioned earlier, your funds will be returned to you within 6 hours after the Settlement Date checkpoint time (08:00 UTC).

As a matter of fact, every investment opportunity comes with risks.

Let’s look at some associated with our topic of discussion:

6. Risk Associated with Binance Dual Investment

Some associated risks with this include:

- Subscribed assets are locked and can’t be canceled or redeemed before the Settlement Date.

- If the asset’s current price moves from your Target Price, you lose the opportunity to buy or sell at a more favorable price.

- Consequently, the trade can only happen based on the price on the Settlement Date.

Note: Binance Dual Trading is not devoid of risks. Ensure you read through the terms carefully before making your investment.

You can visit the Binance website for more information on Dual Investment.

Before we draw the curtain for today, let’s do a quick summary below:

7. Conclusion

Following this post, we learned that Binance Dual Investment allows you to earn passive income no matter which direction the market goes.

Dual investment is similar to Automated trading; however, it comes with the benefit of continually earning even when your assets are on hold.

As a disadvantage, any asset for subscription in the Binance Dual Investment product is irredeemable & locked until the Settlement Date.

I hope this post has introduced to you another opportunity to earn extra in your crypto investment journey.

Before you go, if you found this piece interesting, you can share it with friends using the social media icons below this post.

Got any questions? Drop them for me in the Comment Box below.

Also, don’t forget to follow us on social media so you don’t miss out on any of our latest posts.

Thank you for reading and always remember to invest wisely 👍

Posts You Might Be Interested In:

0 Comments