Over 70% of retail traders lose money on exotic pairs because of unpredictable spreads and slippage.

The gap between a profitable trader and one who struggles often comes down to a single, overlooked factor: choosing the right currency pairs.

Beginners often chase exotic pairs for explosive moves, but seasoned traders stick to those with high liquidity, healthy volatility, and stable spreads — the traits that drive long-term success

In this post, we’ll break down the best Forex pairs for day trading, swing trading, and carry trades, plus the ones you should avoid, and why most traders get them wrong.

Post Summary

- How Forex Pairs Are Categorized

- Best Forex Pairs for Different Trading Styles

- Forex Pairs to Avoid (And Why)

- Advanced Forex Pair Selection Strategies

- FAQs

- Conclusion

Want to Master Crypto & Forex Trading?

Jude Umeano, one of Nigeria’s most respected and successful traders just launched Afibie, a mentorship platform built to help you earn your first $10,000 and beyond from the markets.

Whether you’re new or stuck at break-even, this is your next step.👉 Visit Afibie now

1. How Forex Pairs Are Categorized

Forex pairs aren’t created equal. They fall into four distinct categories, each with unique risks and rewards:

| Category | Examples | Key Trait |

| Majors | EUR/USD, USD/JPY | High liquidity, tight spreads |

| Minors (Crosses) | EUR/GBP, AUD/JPY | Moderate spreads, less liquidity |

| Exotics | USD/TRY, EUR/SEK | Wide spread, high risk |

| Commodity Pairs | AUD/USD, USD/CAD | Tied to oil, gold, or exports |

(i) Major Pairs (EUR/USD, USD/JPY, GBP/USD, USD/CHF)

These pairs, all involving the US dollar, make up roughly 75% of global Forex volume.

Their extreme liquidity means tight spreads (often below 1 pip) and minimal slippage, making them ideal for high-frequency strategies.

For example, EUR/USD typically moves 60-80 pips daily, with volatility peaking during the London-New York session overlap (8 AM – 12 PM EST).

(ii) Commodity Pairs (AUD/USD, USD/CAD, NZD/USD

These pairs move in sync with commodity prices.

AUD/USD, known as the “Aussie,” closely tracks iron ore prices, Australia’s top export, and often rallies when demand from major buyers increases.

USD/CAD tends to move inversely to crude oil, with the Canadian dollar strengthening when oil prices rise.

(iii) Minor Crosses (EUR/GBP, AUD/JPY, EUR/CHF)

These exclude the USD and are slightly less liquid. However, they offer unique opportunities.

EUR/GBP, for instance, is a favorite for range traders due to its historical tendency to oscillate between 0.8500 and 0.9000.

AUD/JPY, on the other hand, is one of the most common currency pairs used in carry trades because of Australia’s high interest rates.

(iv) Exotic Pairs (USD/TRY, EUR/SEK, USD/ZAR)

Exotics can deliver massive price swings but come with dangerously wide spreads (often 10–50 pips) and sudden gaps.

USD/TRY, for example, can move 5% in a single day due to political instability in Turkey.

Unless you’re highly experienced and well-equipped, it’s best to steer clear.

Now that you understand the distinct categories of currency pairs, let’s break down the top-performing pairs for different trading styles.

2. Best Forex Pairs for Different Trading Styles

A. Best for Day Trading (High Liquidity + Volatility)

Day traders need tight spreads and rapid price action. These pairs deliver:

- EUR/USD

- Why? Most liquid pair, reacts to ECB/Fed news

- Typical daily range: around 60–80 pips

- Best session: London–New York overlap

- USD/JPY

- Why? Bank of Japan interventions create sharp moves

- Scalping Tip: Trade during Asian session

- GBP/USD

- Why? The lingering economic and political effects of Brexit continue to trigger sharp price moves

- Risk: Can experience sudden, large price gaps during major UK news events

B. Best for Swing Trading (Trend-Friendly Pairs)

Swing traders hold for days/weeks. These pairs trend strongly:

- AUD/USD

- Why? Follows iron ore prices and China’s economy

- Often rallying when demand for Australia’s exports increases

- USD/CAD

- Why? Tied to oil (Canada’s top export)

- Strategy: Go long USD/CAD when oil falls

- EUR/CHF

- Why? SNB (Swiss National Bank) interventions create multi-week trends

C. Best for Carry Trading (High Interest Rate Differentials)

Profit from swap rates with these pairs:

- AUD/JPY

- Why? Offers positive swap on long positions due to Australia’s higher interest rates compared to Japan

- Risk: The yen often strengthens sharply during market panics, which can wipe out gain

- USD/MXN

- Swap Rate: +5.1 pips/day (long)

- Risk: High volatility

Forex Pairs to Avoid (And Why)

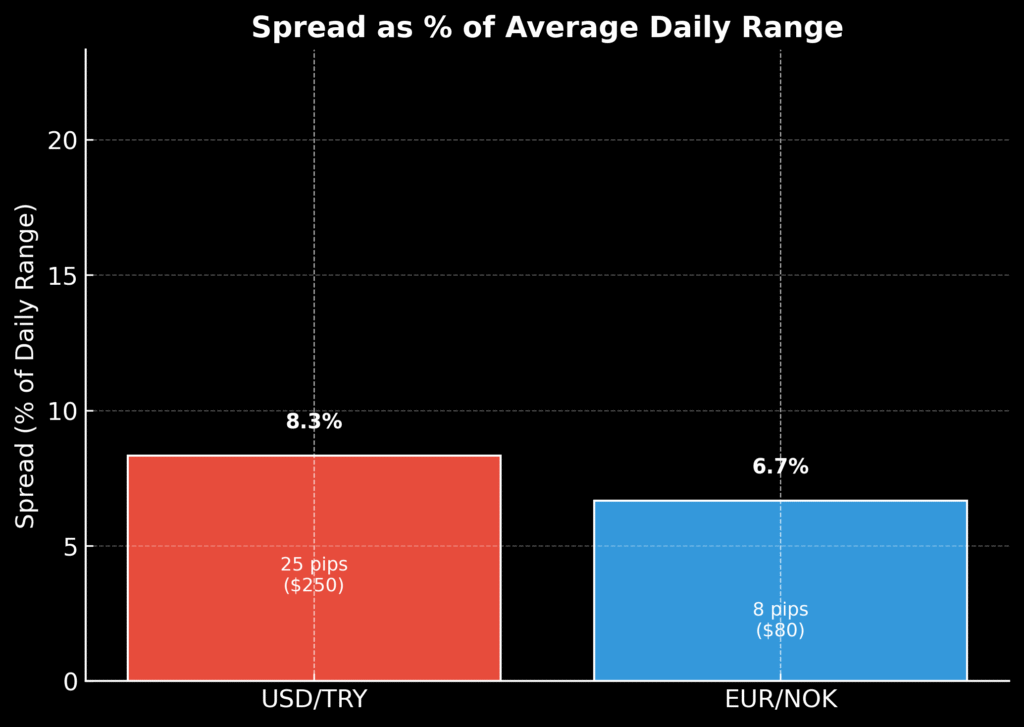

Exotics: USD/TRY (instant drag on P&L)

Exotic pairs have much bigger spreads than major pairs, which means you start a trade in the negative.

With USD/TRY, the spread can be around 25 pips — that’s roughly $250 lost instantly on a standard lot before the price even moves.

Add Turkey’s unpredictable economy and sudden policy changes, and this pair can swing wildly in hours.

For most traders, the risk is far greater than the potential reward.

Low-liquidity majors: EUR/NOK (slippage magnet)

Thin order books mean thin safety nets. EUR/NOK may look calm in quiet hours, but during news, slippage of 5–10 pips is common, especially on market orders.

On a standard lot, that’s an instant $50–$100 loss you didn’t plan for.

For strategies that depend on tight stops and small profit targets, that execution drag can flip a winning setup into a losing one without warning.

Bottom line: Pick your battles. If a pair’s spread is a big chunk of its average daily range, you’re fighting uphill.

Exotic and low-liquidity pairs demand bigger stops, smaller size, and iron discipline.

Most traders are better off sticking to liquid majors unless they have a specific macro edge.

Advanced Forex Pair Selection Strategies

Here are some winning Forex pair selection strategies you can adopt for successful trades.

Correlation Trading: Hedging Smarter

Certain currency pairs tend to move in predictable relationships, either in sync (positive correlation) or in opposite directions (negative correlation).

For example, EUR/USD and USD/CHF often show a strong negative correlation, meaning when one rises, the other tends to fall.

This happens because both pairs have the U.S. dollar as one side of the quote, and market flows into or out of the USD impact them in opposite ways.

Professional traders and hedge funds use this relationship to reduce directional risk.

A common setup is to short EUR/USD while simultaneously longing USD/CHF.

Gains on one leg can offset losses on the other if the U.S. dollar moves unexpectedly, effectively smoothing out equity curve volatility.

Retail traders can replicate this approach with brokers that offer hedge mode, a feature allowing you to hold offsetting positions without extra margin requirements.

The key is proper sizing: ensure your position values are balanced so that the exposure to the USD is nearly neutralized, leaving you to trade the relative performance of the euro and the Swiss franc.

Seasonality: Timing Your Trades

Currencies aren’t just driven by technical levels and economic data, seasonal patterns also play a role.

For example, USD/JPY has historically shown recurring tendencies tied to Japan’s corporate and investment flows.

Japanese exporters often repatriate overseas earnings early in the year, creating upward demand for the yen and, in turn, downward pressure on USD/JPY.

Later in the year, especially in the final quarter, risk-off sentiment and year-end positioning can drive demand for the U.S. dollar, pushing USD/JPY higher.

Traders can use this knowledge to align trade direction with seasonal tendencies rather than fighting them.

While no seasonal pattern works every year, combining them with technical confirmation, such as breakouts in the seasonal direction or supportive macro conditions can significantly improve the probability of success.

Applying these strategies when choosing a forex pair can greatly improve your chances of making a profitable trade.

However, always check correlations against recent data, as relationships can weaken or even reverse when market conditions change.

Also, backtest seasonality on your chosen timeframe, and use filters like trend direction or macro bias to avoid blindly following the calendar.

Let’s move on to the FAQ section!

FAQs

EUR/USD, with 28% of global volume. Its liquidity makes it ideal for beginners.

GBP/JPY (avg. 120 pips/day), but its volatility requires tight risk management.

EUR/USD. Low spreads and predictable reactions to Fed/ECB news.

In day trading, speed, tight spreads, and reliable execution can make all the difference.

You want a broker that won’t hold up your orders or limit your trading style.

EXCO Trader fits the bill — their no-dealing-desk setup sends trades straight to the market, giving you lightning-fast execution and low costs that help keep more profits in your pocket

Conclusion

The difference between random trading and making profits again and again is often about choosing the right currency pairs.

Liquidity, volatility, spreads, and correlation are not just big trading words, they are the basics of a good trading plan.

Whether you enjoy the quick action of day trading EUR/USD, the steady trends of swing trading AUD/USD, or earning interest from AUD/JPY, success comes from matching the right pair with the right strategy at the right time.

Ultimately, the market will always move. The question is—will you move with it or ahead of it? Start trading on EXCO Trader today!

0 Comments